You Invest Time In Your Business We Take Care Of Your Bookkeeping

Simple functional solutions, to help you grow.

start a free trial

We are experienced professionals, whose job is to help you concentrate on the core functions of your business.

We Keep Your Books Up-To-Date and Maintain Your Financial Records.

Save Time and Get All Your Year-Round Bookkeeping Requirements Delivered to You.

With Regularly Reconciled Books, You Never Miss A Financial Transaction Again, Even The Smallest Ones.

Our Team is Your Team. Each Business Has Different Accounting Needs. And We, At Accounts Confidant Are Ready To Meet You Where Yours Are. Our Bookkeepers Are Experts In Financial Software Like – Sage, QuickBooks, FreshBooks, etc. Our Experience with the Virtual Accounting Infrastructure Leaves No Need For An On-Site Accountant. We Are Globally Functioning and Assist You In The Time-Zone You Operate In! We Provide You The Complete Support In Accounting Technology, Organization and Advisory. We Are Your Personal Team of CFO’s to Partner You In Growth and Acceleration. In Case You Have A Query, Get In Touch With Us And Get A Solution In 24-Hours!

Our Dedicated Project Managers Give You All The Updated Financial Information At The Time And Convenience You Want.

Outsourcing Bookkeeping Helps You Save The Space And Pay of An In-House Accountant

Our Reliable Systems Ensure That Your Precious Financial Data is Maintained With Superior Security Standards.

These guys were very professional and handed my financial reports and statements every 15 days. I recommend them if you are looking for a system to organize your bookkeeping.

Talk about smooth bookkeeping and there is no one that will come to your mind but them. They have made my year end tax season so easy!

What Accounts Confidant did differently for me was to help me with an attentive ear. They helped me file my taxes online as well.

These guys were very professional and handed my financial reports and statements every 15 days. I recommend them if you are looking for a system to organize your bookkeeping.

Accounts Confidant was such a breath of fresh air when it came to my first tax season with them. It actually ended up becoming the smoothest time of the year.

Accounts Confidant has been handling my bookkeeping services for the last 2 years. They are always on point, run by a schedule and very attentive.

A client came to us with a unique case. She had not filed her taxes for 5 years. As she was battling cancer, the time passed without her reconciling her finances, missing vendor payments and generating invoices.

A client approached us with a very generic and omnipresent issue that our clients hold, why should they make the transition from in-house to virtual bookkeeping.

A client came to us with a unique case. She had not filed her taxes for 5 years. As she was battling cancer, the time passed without her reconciling her finances, missing vendor payments and generating invoices.

A client approached us with a quarter’s worth of missing vendor bills because of which she was unable to file her taxes. She had a race against time and tax compliances at the time she approached us.

QuickBooks Payroll simplifies payroll processing, tax calculations, and employee management. Small and medium-sized businesses, accountants, and payroll managers rely on its capabilities to handle employee payments and ensure compliance with tax regulations. However, users sometimes encounter a frustrating issue where payroll updates fail to install or process correctly. Several factors can cause the “QuickBooks Payroll

Switching from QuickBooks Desktop to QuickBooks Online might seem daunting, but it doesn’t have to be! Imagine upgrading your old manual car to a hybrid. You are getting the best of both worlds: the familiarity of QuickBooks with the added benefits of the cloud. Now, you might be wondering, why should you make the switch?

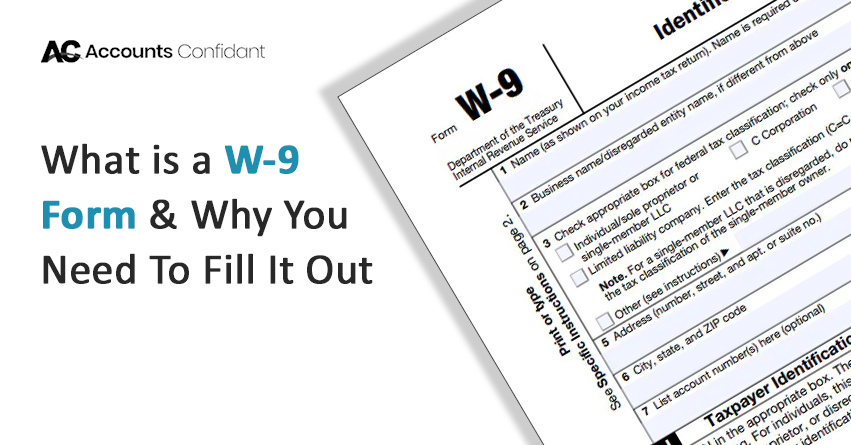

Form W-9 is a very basic IRS form having only one purpose. It allows you to communicate your Tax Identification Number (TIN), which is also known as your Employer Identification Number (EIN) or Social Security Number (SSN), to another individual, bank, or financial institution. The W-9 is a simple “information return,” which means it’s only

Looking for help? Talk To Our Bookkeeping And Taxation Experts and Get Your Issue Solved!

Toll-Free: 1-844-860-1101