We Process Invoices

We Will Track Inventory

Follow-Up Potential Payments

In every business, there comes a time when you might not receive payments on time or you might notice a discrepancy. If your business experiences a change in the overall efficiency of your accounts receivable system then it’s time for you to outsource this task to an accounts receivable service provider. This is where Accounts Confidant can help your business. Our expert accountants and bookkeepers have years of experience when it comes to managing accounts receivables. Moreover, our accounts receivable services cost way lesser than employing an in-house account, receivable management team.

We provide accounts receivable services to customers all over the globe and offer a comprehensive range of end-to-end solutions. Some of our services include:

The following are some of the various benefits of outsourcing services to Accounts Confidant:

When you hire our accounts receivable services to handle your accounts receivable, you also eliminate the need for your company to have an accounts receivable department within your own office. You won’t need to employ staff and purchase expensive equipment. Our services will also enable you to use your time and money into improving your sales and creating a strong relationship with your customers.

We can enhance the efficiency to higher levels, as soon as you outsource the work. The same work, which might be done manually also, can be automated and experienced staff can be hired at lower costs, to enhance efficiency.

Many businesses have round the clock service requirements. Outsourcing is often considered to be a great tool, especially, when it can provide massive round the clock coverage to small businesses and companies alike.

Our accounts receivable services will help you collect your payments in a faster and timely manner. We also use advanced electronic billing solutions and payment options for faster payment collection and processing. Customers can pay you before their accounts reach the due date through mobile credit payments or electronic transfer. This also helps improve your whole cash flow.

We will ensure that you receive all kinds of accounting information whenever you need them. You can also get personalized reports with the help of advanced software at any time of the day. All this is a sure-shot way to come up with quick financial decisions which are also a must to match up to the competitive business environment of today.

Even though the work is being done offsite, there are a lot of ways and means to track the work being completed. With the help of our cutting edge software and technology allows everyone to stay on top of the completed work and keep an extensive track of what’s completed and what’s pending.

In addition, we regularly run elaborate quality checks in place to ensure maximum quality control for the clients. This way, we maintain top-notch quality without having to worry too much about errors and wrong information handling.

We understand that you as a business head have numerous responsibilities to take care of. That is why we at Accounts Confidant are here help make your tasks easier. Our approach has been specifically designed to provide you with all the benefits of an in-house team without spending too much on infrastructure management.

If you are looking for an accounts receivable outsourcing partner, feel free to get in touch with us or talk to one of our representatives.

QuickBooks Payroll simplifies payroll processing, tax calculations, and employee management. Small and medium-sized businesses, accountants, and payroll managers rely on its capabilities to handle employee payments and ensure compliance with tax regulations. However, users sometimes encounter a frustrating issue where payroll updates fail to install or process correctly. Several factors can cause the “QuickBooks Payroll

Switching from QuickBooks Desktop to QuickBooks Online might seem daunting, but it doesn’t have to be! Imagine upgrading your old manual car to a hybrid. You are getting the best of both worlds: the familiarity of QuickBooks with the added benefits of the cloud. Now, you might be wondering, why should you make the switch?

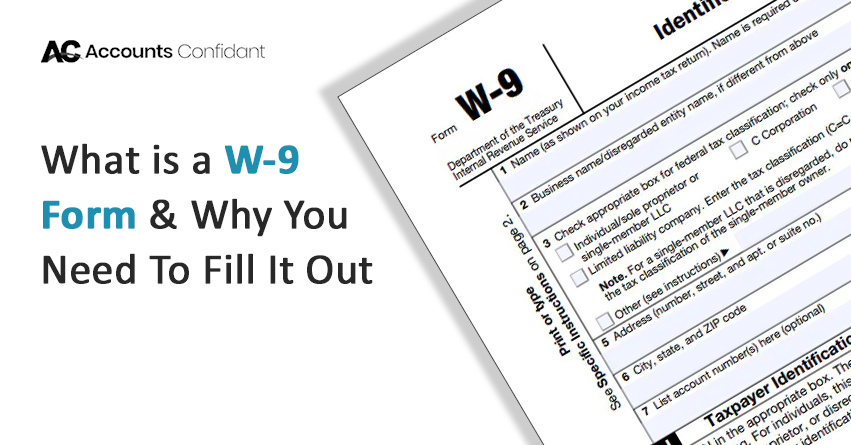

Form W-9 is a very basic IRS form having only one purpose. It allows you to communicate your Tax Identification Number (TIN), which is also known as your Employer Identification Number (EIN) or Social Security Number (SSN), to another individual, bank, or financial institution. The W-9 is a simple “information return,” which means it’s only

Looking for help? Talk To Our Bookkeeping And Taxation Experts and Get Your Issue Solved!

Toll-Free: 1-844-860-1101