Keep A Check of The Benefits

Be Compliant To The Regulations

Use Time And Money Efficiently

It is paramount for every business to perform payroll processing for its employees in an accurate and timely manner. However, it can be a very complicated task to handle when you are running a business. You will need to handle dynamic HR inputs like leaves and varied salary structures. Moreover, you will have to comply with the statutory and tax regulations that change from time to time.

Taking care of payroll processing whilst managing your business can be overwhelming but you need not fret. You can always outsource this task to outside payroll processing services. Now, this is where Accounts Confidant comes in.

With years of experience in small business payroll processing, we maintain the utmost accuracy in payroll processing. Our team of highly qualified chartered accountants ensures complete confidentiality while providing transparent employee communication, meeting statutory requirements and doing basic payroll calculations.

The following are some of the numerous services you can avail once you enlist our help:

Take a look at the various benefits you can reap by hiring our services:

For small and mid-sized businesses payroll processing takes time and attention away from management tasks and other key areas that are equally important. By outsourcing your payroll processing tasks to us, you can cut the time spent on payroll to a minimum.

In the establishment stage of your business, your focus should be towards seeing the company move forward. When you hire our payroll processing services, you’ll have time and resources to focus on the essential areas of the company. It can be a tedious process that can derail your time and attention. At Accounts Confidant, we are dedicated to freeing up your time by taking over your payroll processing responsibilities, so that you can focus on growing your business.

Getting into legislative trouble with the government is every business owner’s worst nightmare. At best, errors can lead to legislative hiccups and at worst, you could be sued or charged with defrauding local authorities because of an error. It simply isn’t worth the risk. Unless you’re completely comfortable with your knowledge of the legal requirements for taxation, social and healthcare insurance, it’s easier, cheaper and less stressful to outsource your payroll processing task to us. Leverage the benefits of having experts managing your payroll processing. We remain up to date with the continually changing rules governing employee salary payments and operate according to agreed services and quality standards.

In order to hire and recruit employees and build teams to deal with payroll processing, you will require a lot of capital. Such processes require money and time and retaining such individuals is not a guarantee. Enlisting our help costs way lesser than hiring an in-house employee. So, by outsourcing your work to us, you will only need to pay us for the required task and nothing more. Doing so will help you save on tons of expenses

At Accounts Confidant, we have a team of experts who have attained years of experience in handling several areas of payroll processing. So, you will be able to seek guidance and consultation from a qualified team of experts who work round the clock.

A lot of times, small businesses do not have access or are not aware of the latest versions of payroll software. However, this is a non-issue as our experts are well versed with all the latest technology thus minimizing the errors and delays caused by lack of knowledge. Also, we keep your data completely secure.

With Accounts Confidant handling your payroll processing tasks, you won’t have to calculate deductions, year-to-date totals, or develop various payroll reports – we do it all for you. Moreover, we provide you with a wide range of services and the personal attention you need.

Some of our stand out points:

Lastly, if you are looking for a cost-effective and reliable payroll solution, look no further, get in touch with Accounts Confidant today.

QuickBooks Payroll simplifies payroll processing, tax calculations, and employee management. Small and medium-sized businesses, accountants, and payroll managers rely on its capabilities to handle employee payments and ensure compliance with tax regulations. However, users sometimes encounter a frustrating issue where payroll updates fail to install or process correctly. Several factors can cause the “QuickBooks Payroll

Switching from QuickBooks Desktop to QuickBooks Online might seem daunting, but it doesn’t have to be! Imagine upgrading your old manual car to a hybrid. You are getting the best of both worlds: the familiarity of QuickBooks with the added benefits of the cloud. Now, you might be wondering, why should you make the switch?

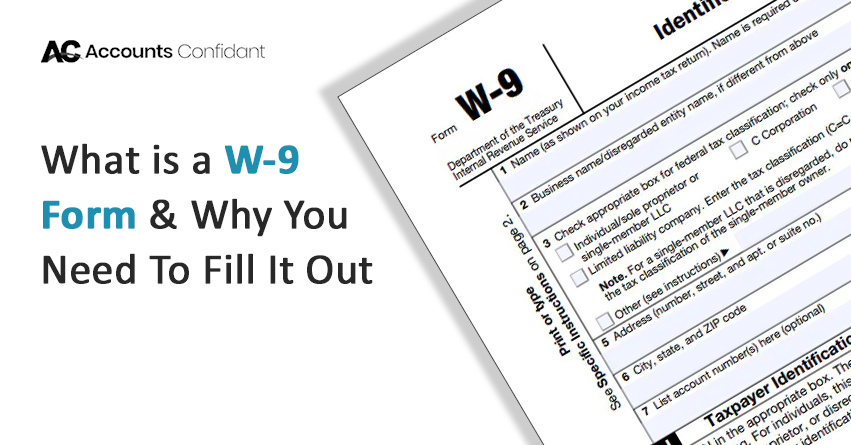

Form W-9 is a very basic IRS form having only one purpose. It allows you to communicate your Tax Identification Number (TIN), which is also known as your Employer Identification Number (EIN) or Social Security Number (SSN), to another individual, bank, or financial institution. The W-9 is a simple “information return,” which means it’s only

Looking for help? Talk To Our Bookkeeping And Taxation Experts and Get Your Issue Solved!

Toll-Free: 1-844-860-1101