Never Miss Another Receipt

Choose The Payment Mode Of Your Choice

Monitor Transactions Instantly!

The ultimate goal of every business is to achieve the maximum possible value from expenditures. It also involves reducing costs as far as possible. Making even a small mistake in the process is the last thing you would want to do. Managing your accounts payable by yourself can be a daunting task at times. You will have to employ full-time staff specifically to handle these things and that can majorly affect your cost-saving plans. This is when outsourcing Account Payable Services comes in the scene. An efficient Accounts Payable process can help your organization to manage working capital and cash flow in a better way. You will also be able to develop strong relationships with your vendors. This way you will do better cost-saving, increase the overall agility of the business. And moreover, it will help you to remain compliant with regulatory policies.

Outsourcing Account Payable Services means you are hiring someone to manage your Accounts Payable department. That person will strategically streamline and organize it. It is cost-effective for a very simple reason as not every company has the necessary scale to afford the services of a full-time CFO. In outsourcing, you are paying someone on the basis of the amount of work they are doing for you and not someone who is sitting for a limited time in your office.

Here, at Accounts Confidant we do the same thing. We manage your AP department entirely so that you do not have to worry about entering any financial data manually and then keeping a track of it.

Outsourcing Account Payable Services will get most of your workload off your hands. Along with taking complete responsibility of your AP system, we improve the overall process and add value to your business.

We are an expert Account Payable Service Provider. Over the years, we have built up a wide clientele that includes businesses of various sizes. This is also one of the many reasons why we have an in-depth understanding of the requirements of customers from different industries. We can help you manage your end-to-end accounts payable tasks. You get constant coverage because we have a team working around the clock 24×7.

Our team tries to address the gap in the market for high quality, financial and strategic tax planning services under one umbrella and that too at affordable prices. Our plan is to minimize risk and maximize results and benefits for our customers.

You can contact us at +1-877-519-7362 (toll-free) to request more information. We will be happy to answer all the queries that you have. We will also help you set up an efficient and effective accounts payable solution.

QuickBooks Payroll simplifies payroll processing, tax calculations, and employee management. Small and medium-sized businesses, accountants, and payroll managers rely on its capabilities to handle employee payments and ensure compliance with tax regulations. However, users sometimes encounter a frustrating issue where payroll updates fail to install or process correctly. Several factors can cause the “QuickBooks Payroll

Switching from QuickBooks Desktop to QuickBooks Online might seem daunting, but it doesn’t have to be! Imagine upgrading your old manual car to a hybrid. You are getting the best of both worlds: the familiarity of QuickBooks with the added benefits of the cloud. Now, you might be wondering, why should you make the switch?

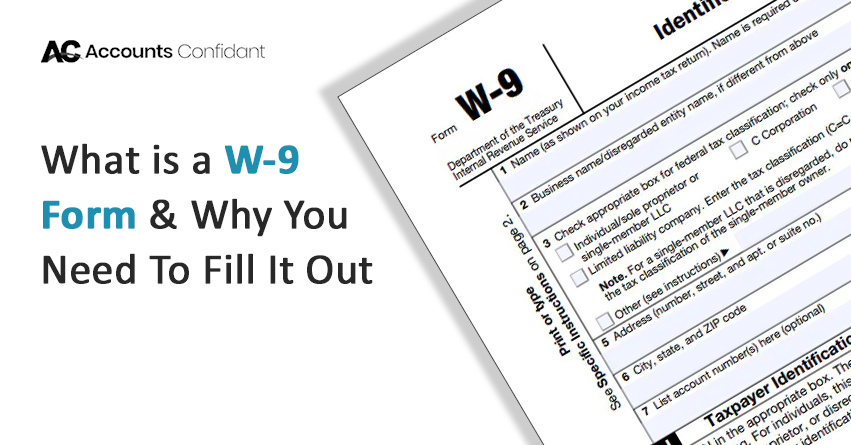

Form W-9 is a very basic IRS form having only one purpose. It allows you to communicate your Tax Identification Number (TIN), which is also known as your Employer Identification Number (EIN) or Social Security Number (SSN), to another individual, bank, or financial institution. The W-9 is a simple “information return,” which means it’s only

Looking for help? Talk To Our Bookkeeping And Taxation Experts and Get Your Issue Solved!

Toll-Free: 1-844-860-1101