Credit Card Reconciliation

Bank Reconciliation

Customer Reconciliation

Nowadays, a large number of businesses are outsourcing their bank reconciliation tasks to experienced service providers. You can help your business free its own beneficial resources and utilize them for other key areas of your operation by taking advantage of this strategy. If you are looking to outsource your bank reconciliation services to a trustworthy third party then you have come to the right place. We provide you with impeccable bank reconciliation facilities that cost way lesser than hiring an in-house CPA. Now, before we go through the various services that you can avail by seeking help from Accounts Confidant, you might be wondering what is bank reconciliation exactly? So, let’s try and understand what bank reconciliation is.

Bank reconciliation is the process of balancing and matching figures in accounting records with those displayed on a bank statement. It is an extremely crucial aspect of handling finances. In other words, if a customer makes a payment, that payment needs to be matched with its corresponding invoice to balance out the amounts effectively.

Our bank reconciliation services are created to ensure that your business finances are exactly as you want them to be.

The following are the various benefits of outsourcing your bank reconciliation tasks to us:

With the help of the outside bank reconciliation services, an organization matches its distributed checks with the amount or entry entered in bank statements. A vigilant review based on proper sheets and procedures helps to disclose fraudulent activities such as payment made for illegitimate business purposes, payments transferred to illicit employees or unauthorized vendors and not revising sanctioned check amounts and details.

Bank representatives may make accounting errors such as transfer wrong sum, record wrong check amount, enter the amount in a wrong bank account, omit an entry from an organization’s bank statement or record a duplicate transaction. Outsourced bank reconciliation services give entrepreneurs time to notify a bank of its errors to find the difference and correct the error.

Outside bank reconciliation service firms let organizations handle their accounts receivable better. When a customer’s payment is cleared from a bank, the receivable remains no longer outstanding and therefore, requires no further action. However, if a client’s check doesn’t clear, that alerts management to be more focused in its collection process.

The on-hold time between cash outflows to vendors and employees as well as payments coming from clients and customers can vary greatly. This particularly affects an organization with very low cash reserves. Outside service providers help entrepreneurs manage or postpone payments that may safeguard organizations from business overdrafts, bounced checks, insufficient funds and extra interests. To explain this with a bank reconciliation example, let’s assume that you have $1,000 in your checking account today. You go to the mall and write a check for $1,250 at a furniture store. Now, to prevent your checks from bouncing, the bank will check your history and provide you with the overdraft facility. You will have to pay this amount back later on though.

So, schedule a consultation with us and allow us to take care of all of your bank reconciliation tasks.

QuickBooks Payroll simplifies payroll processing, tax calculations, and employee management. Small and medium-sized businesses, accountants, and payroll managers rely on its capabilities to handle employee payments and ensure compliance with tax regulations. However, users sometimes encounter a frustrating issue where payroll updates fail to install or process correctly. Several factors can cause the “QuickBooks Payroll

Switching from QuickBooks Desktop to QuickBooks Online might seem daunting, but it doesn’t have to be! Imagine upgrading your old manual car to a hybrid. You are getting the best of both worlds: the familiarity of QuickBooks with the added benefits of the cloud. Now, you might be wondering, why should you make the switch?

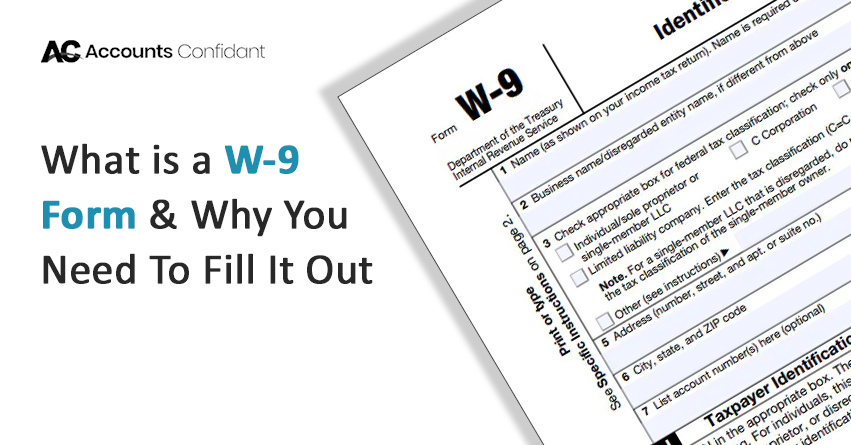

Form W-9 is a very basic IRS form having only one purpose. It allows you to communicate your Tax Identification Number (TIN), which is also known as your Employer Identification Number (EIN) or Social Security Number (SSN), to another individual, bank, or financial institution. The W-9 is a simple “information return,” which means it’s only

Looking for help? Talk To Our Bookkeeping And Taxation Experts and Get Your Issue Solved!

Toll-Free: 1-844-860-1101