1099 form is also known as the information return, from where the various sources an individual earns his/her income from is recorded. These sources are apart from the employer and the earnings are apart from the wages. As there are multiple sources an individual can earn his/her earnings from, there are 20 different variants of the 1099 form, specific to each. 1099 MISC is the most common and widely used variant of it.

1099 MISC is a subsidiary of the 1099 form that records miscellaneous income. There is a large spectrum of earnings that come as a part of it, namely:

- Rent

- Royalty

- Prize and award winnings

- Independent contractor earnings

- Proceedings as a freelancer, etc.

The form at the end of the earning period (The year previous to the year of filing) records the number of payments that an individual receives from a person or entity. 1099 MISC form is sent by every individual/ entity that you worked for before January 31st. Another copy of the same form is sent to the IRS by the last day of February. The minimum amount of issuance for the 1099 MISC is $600 in earnings from the company you served.

What is a 1099 MISC form Comprising Of?

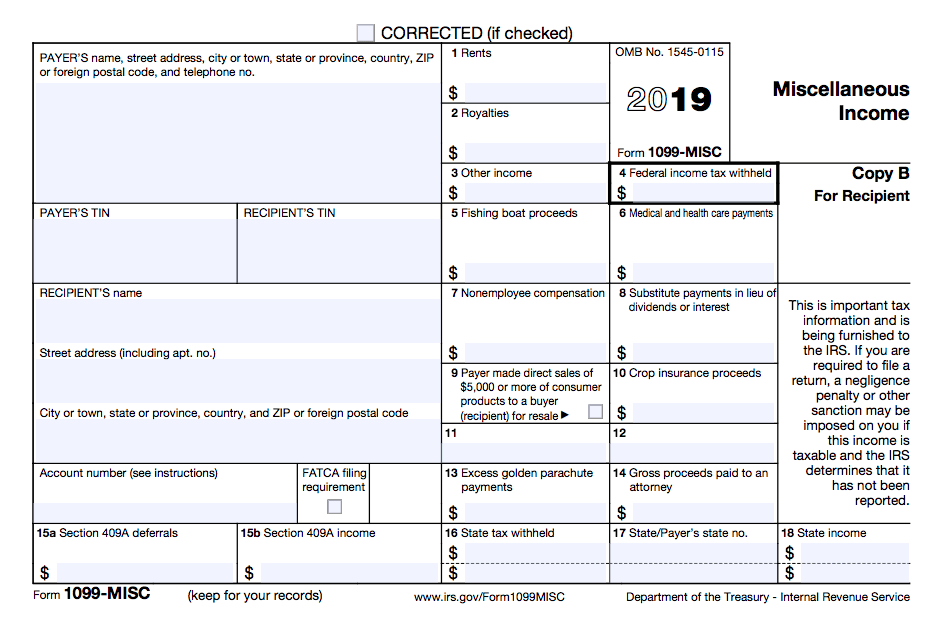

The 1099 MISC comprises of a total of 5 parts. These are as follows:

- Copy A: This is submitted to the IRS by the taxpayer. (i.e. your business)

- Copy 1: This part is sent to the state tax department by the taxpayer.

- Copy B: The taxpayer receives this. (Before January 31st)

- Copy 2: For the purpose of filing with the state tax return, this copy is sent to the recipient.

- Copy C: The final copy is kept by the taxpayer.

Where to Get 1099 MISC forms?

The 1099 MISC form can be obtained from a payroll processing services provider, tax services provider, or directly from the IRS. A point to note here is that Copy A of the 1099 MISC form cannot be downloaded from the internet as it comes in a specific red ink that cannot be duplicated and printed.

How to File 1099 MISC?

A large part of relying on compliances is to do with how well the 1099 MISC forms are prepared and filed. We will guide you through the step by step process on how to file 1099 MISC.

There are two copies of the form, Copy A and Copy B.

As stated above, Copy A is sent by the individual or company who sought the services to the IRS and alternatively, Copy B is sent to the individual who served the entity or the individual. As a note, you do not need to send copy B to the IRS. You can instead, use the income listed on that to report your personal income tax return. For the purpose of this blog, we will stick to the process of filing the form for independent contractors.

1. Complete all the Required Information:

In case you hired an independent contractor, then before you begin the filing process for the 1099 MISC, you need to have the following information complete and ready.

- The total payment you made to the contractor during the tax year. (This time period will be previous to that of the filing.)

- The name of your contractor on their legal documents. (This should be the name that their Social Security Number is registered under.)

- Next, is to take note of their complete registered address.

- Up until your “non-employee” is a non-resident, you also need to mention their unique taxpayer identification number. (i.e. their social security number)

- You can now use the information to fill the 1099 MISC form.

| Quick Tip: In order to get all the information stated above, you can seek each of your independent contractor’s W-9 Forms. A healthy employment practice is to have all your independent contractors fill a W-9 Form. |

2. Before the Last Day of February, Submit Copy A to the IRS:

- Regardless of whether you file electronically or by mail, the Copy A of the 1099 MISC should reach the IRS before the last day of February.

Physical Submission:

- In case you are filing a physical form, please note that Copy A cannot be downloaded and sent to the IRS. (Please refer to the sections above to see the reason). In such a case, you will have to opt for the physical form and then mail it to the IRS.

Online Submission:

- You can e-file Copy A electronically. The pre-requisite here is to have compatible accounting software.

- The system is called Filing a Return Electronically. (FIRE)

- To be able to access fire, you will need TCC (i.e. Transmitter Control Code). One needs to fill the form 4419 to request permission to use TCC by the IRS.

- The form 4419 needs to be filled at least 30 days before your tax deadline.

3. Submit Copy-B to the Recipient:

Physical Submission:

- On the completion of the 1099 MISC, a copy also needs to be sent to the recipient. This is Copy B and should be sent across to the “non-employee” before January 31st.

- Contrary to Copy A, Copy B can be downloaded and printed from the IRS’ official website.

Online Submission:

- You can send Copy B to the recipient electronically, but the key here is to send it with their consent. For example, if you plan on sending the recipient the form through the mail, then you also need to gain their consent through email.

4. Fill and Submit Form 1096:

- In case you have opted to file the physical copy of the Form 1099 MISC, then you also need to simultaneously file Form 1096.

- This is used to track every 1099 form by the IRS.

5. Re-Check Whether There Are State Submissions Needed:

- As stated in the sections above, Copy 2 and Copy C are meant for the state tax returns. Depending on where your business is based, you also need to check whether you are compliant with your state’s filing requirements.

Common Errors While Filing 1099 MISC form:

Tax compliances are not only necessary but are also given prime importance by taxpayers. In order to be compliant, it is also necessary to know the common errors that can creep in your filing process and the ways to overcome them. Here are some of the common errors that are encountered while filing the 1099 MISC form:

1. Filing and Applying for the Wrong Year:

The most common error while filing the 1099 MISC form is to confuse the year of recording earnings with the year of filing. The form is filed to record the earnings made in the previous year to that of filing. For example, the payments earned in the year of 2019, shall be recorded in the form for 2020.

2. Downloading and Sending Copy A to the IRS:

The red ink that is used on Copy A and sent to the IRS, is a unique link that cannot be copied and duplicated with a printer. Therefore, downloading and sending the forms to the IRS is a common error that needs to be avoided.

3. Sending 1099 MISC Form to an Employee:

The form is reserved to be sent only to non-employees, and sending your full-time, regular employees is a mistake. The form that needs to be used there is W-2.

4. Making Errors in the Form:

There are some generic errors that can creep in your form filling process. Some of these are failing to include cents in the amounts, not using black ink for filing, making the entries too large or small, not using the correct format to write the employee’s name and other corresponding information, etc.

Penalties on 1099 MISC Form:

Just like every other form of the IRS, the 1099 MISC form too when one fails to comply with the correctness, guidelines, and deadlines.

- A taxpayer will have to pay a fine of $50 if the last date deadline has been missed but still is within 30 days.

- The fine increases to $100, if the filing is more than 30 days late, but before August 1.

- The fine exceeds $260 if the filing is after August 1.

- A fine of $530 is levied, if a taxpayer intentionally fails to file the 1099 MISC form.

Wrapping Up:

If you have hired freelancers and independent contractors for your business, or are currently working as one, then the 1099 MISC form is integral for you. This blog talked about what it means, where you can get it and how to accurately file it.

A tax form is based on how appropriately can you stick to its filing guidelines and, deadlines as well as the validity of the information.

If you are in the process of filing the 1099 MISC form or are looking for expert tax accountants who can help organize the process better, then our team at Accounts Confidant is the perfect fit for you. To get in touch with us and see how easy we can make your 1099 MISC filing, call us on +1-888-660-0575 and get started today!