The two major parts of a company’s working capital are its current assets and liabilities. Additionally, both these accounting entries are a part of the double-entry bookkeeping. These general ledger entries are incurred when the revenues and expenses are incurred and not when they are actually exchanged. Furthermore, in bookkeeping, these are called accounts receivable and accounts payable. In this blog, we will cite the differences between accounts payable vs accounts receivable.

Accounts Payable Vs Accounts Receivable-What Do The Two Mean?

There are two sides to every transaction, Accounts Receivable and Accounts Payable are two interrelated but separate parts of a business’ transaction.

Accounts Receivable is the money that a customer owes to your business for the goods you sold or the services you performed.

Accounts Payable is the amount your business owes to a supplier when the goods are purchased and services are availed. AP includes both short-term and long-term debt promises.

For instance, Company X sold merchandise to Company Y (on credit). Company X will record the amount of sale with a credit to the sale and a debit to the accounts receivable. Company Y, on the other hand, records the purchase with credit to Accounts Payable.

When there is a larger part of the cash flow going out through AP, and not enough coming in from the receivable, to balance the former out, it leads to negative cash flow. Therefore, it is important to understand the individual importance of each

Now that we have cleared that they are two major accounting entries determining the cash flow in a business, we are now going to determine the difference between the two.

Accounts Payable vs Accounts Receivable: The Key Differences:

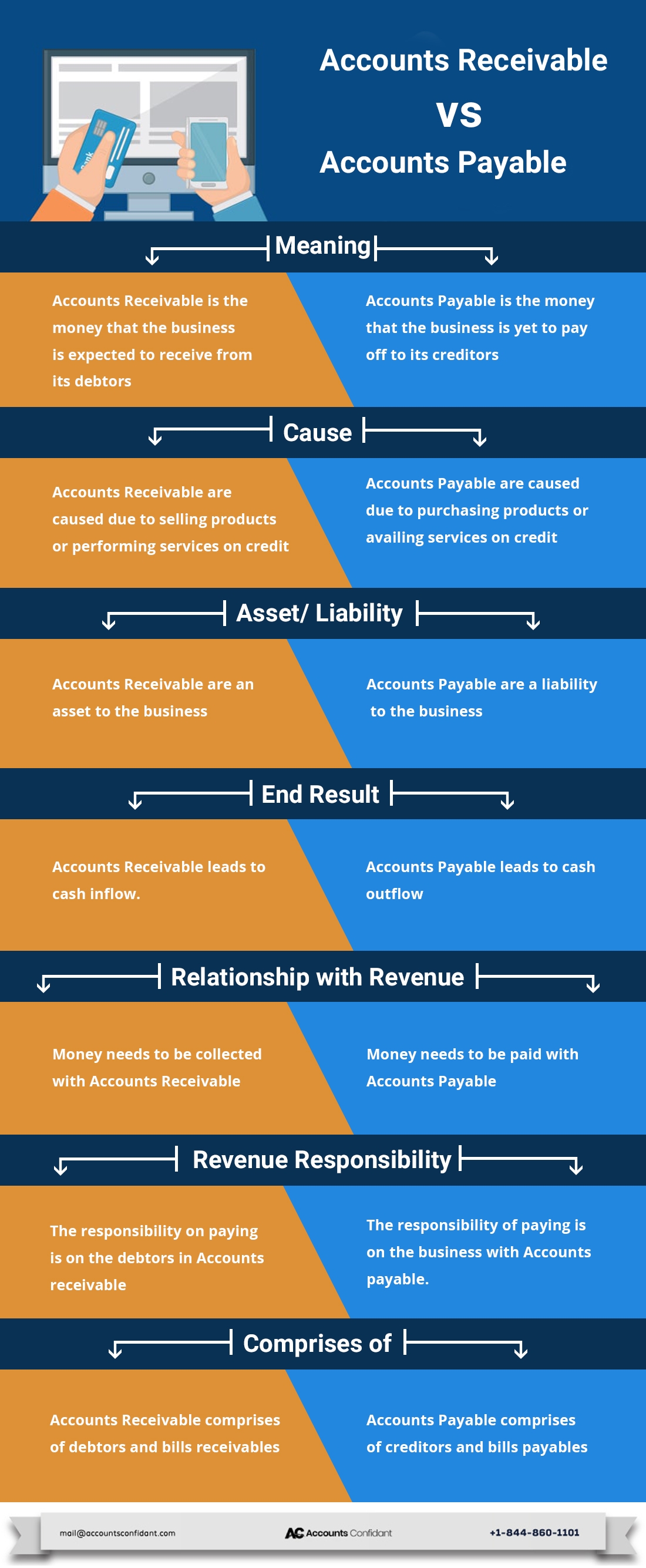

When the two sides of a transaction, Accounts Receivable vs Accounts Payable compared, these are the key differences:

- Firstly, accounts receivable are the goods sold for which the revenue is yet to be received. AP is the expense that you are due to make to the supplier for the goods bought/ services availed.

- Accounts receivable is a current asset, whereas accounts payable is a current liability.

- AR stems from credit sales whereas AP is a result of the credit purchases.

- Furthermore, in the case of the former, money needs to be collected and in the case of the latter, money needs to be paid.

- Meanwhile, AR ensures an inflow of cash and AP ensures an outflow of cash.

- The money owed by the company is Accounts Receivable, but the money owed by the company is the accounts payable.

- Finally, the two primary components of accounts receivable are billed receivable and debtors. On the other hand, the two primary components of accounts payable are billed payable and creditors.

Also Read:- How to Migrate from QuickBooks Desktop to Online?

Conclusion:

Every transaction is done on credit has an element of accounts receivable and accounts payable in it. Therefore, understanding these two concepts is essential to be able to balance them effectively to stay cash positive. It is also imperative to record them perfectly so that your books are always updated and error-free. A complete understanding of accounts receivable vs accounts payable is important to handle them in the right way. If you too are looking for a team of expert bookkeepers, who can help streamline your AR and AP logging, then you can contact our team of CFO’s on +1-866-301-2307 and get started today.