What Is Federal Income Tax?

To understand the meaning of the term Federal Income Tax, it is important to bifurcate it into the two important terms that make it. Doing that will help you get a holistic understanding of what it means and how it impacts your tax filing.

Federal Tax: Federal Taxes are the funds used by the government to use for the growth and upkeep of a country. These taxes are collected by the city, state or the country from individuals and corporations. When the tax collected is credited to the government of the country’s account, it is then referred to as federal tax!

Income Tax: An Income Tax is levied by the IRS on the annual earnings of individuals, corporations, trusts and other legal entities. This applies to all forms of earnings that constitute a taxpayer’s taxable income. This includes both their earnings as well as capital gains of any form.

So to put together, Federal Income Tax is paid by employed individuals and corporations (legal and non-legal), the sum of which is used by the government as a source of revenue to fuel the nation.

Which is why income tax and federal income tax are similar in essence and yet are different.

In this article, we will talk about everything related to Federal Income Tax.

What is the Federal Income Tax Rate?

The Federal Income Tax Rate has been divided into seven tax rates ranging from 10% to 37% which are proportional to the income the taxpayer earns.

The Federal Tax brackets divide the income tax rates in a range of divisions with respect to the corresponding income.

These ranges or Federal Tax Brackets are calculated and deducted on the basis of an individual’s taxable salary and are divided as follows:

- 10%

- 12%

- 22%

- 24%

- 32%

- 35%

- 37%

Read the following to get a comprehensive knowledge of how the Federal Income Tax Rate calculates and how the Federal Tax Brackets work.

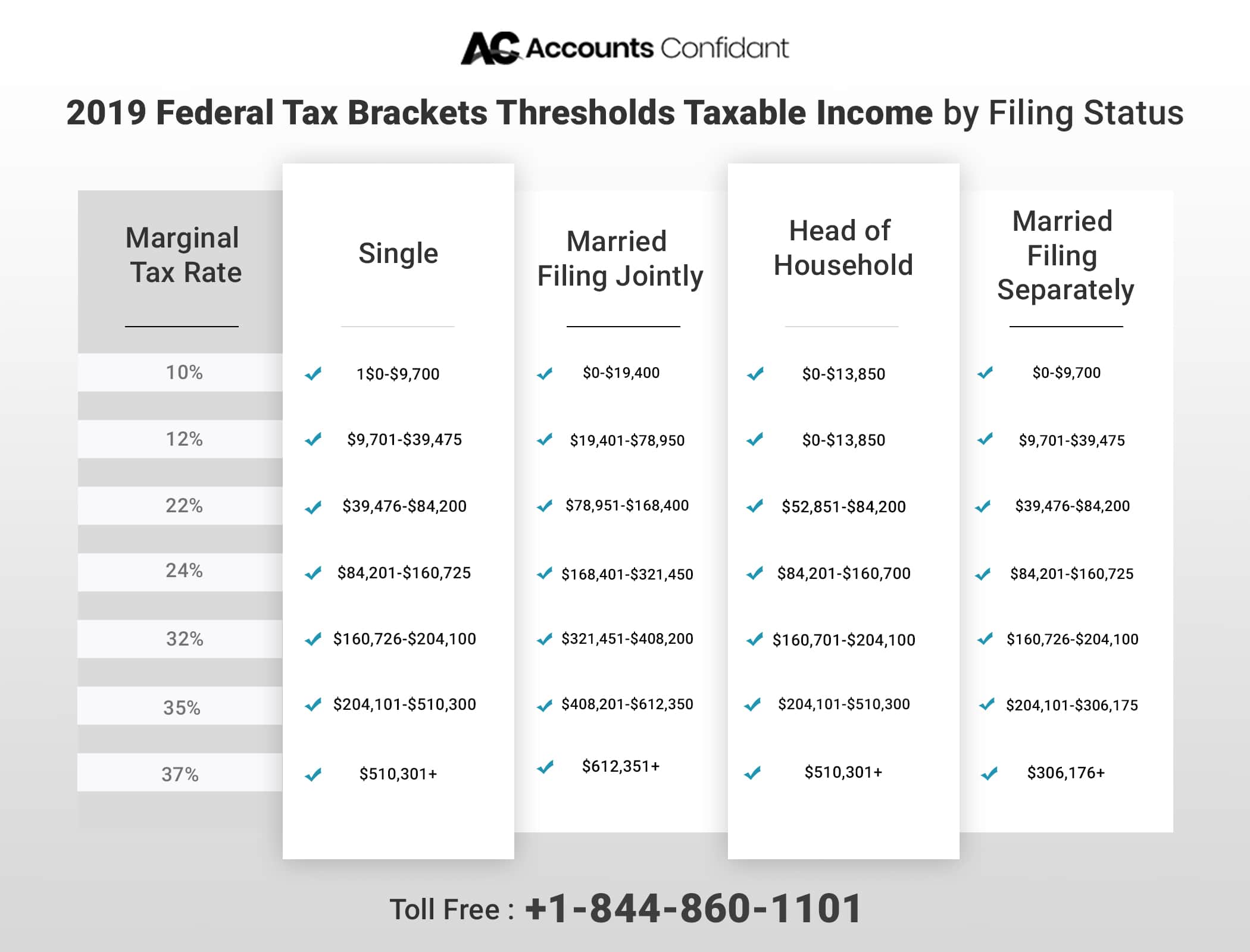

- The Federal Tax Rate applies on the income in different ranges (brackets), which are entirely dependent upon the tax payer’s filing status.

- As case exceptions, additional tax timetables apply to individuals who file as heads of the family unit and to wedded people filing separate returns.

- Additionally, a separate timetable of tax rates applies to capital increases and profits.

- Another important thing is that the Federal tax rate only applies to the salaries in a specific tax bracket.

- Add to that, each tax rate applies to salaries only lying in a particular bracket; in cases where an individual has been able to get a higher remuneration, to therefore fall in a higher tax bracket, then their gross salary is not taxed at that rate, but rather only the part of the pay that lies in that section.

Therefore, the higher your salary, the greater the portion of it you will be covering in government obligations. The theory behind this is that the more money you earn, the greater will be your capacity to pay taxes as compared to someone who in turn earns less pay.

How to File a Federal Income Tax Return?

Here is all that you need to do to prepare and file your tax files this season.

Note: The new tax law has changed the forms, credits, and findings you may have utilized before.

- Gather all your paperwork

That generally includes all the ones listed below:

- A W-2 form required for each business

- Other proclamations (1099 and 1099-INT structures)

- Medical insurance coverage

- Choose your Filing Status— Your marital status and or whether you pay for a nuclear family unit.

- Choose how you have to file your taxes – The IRS utilizes tax preparation software for easiest tax returns.

- Get free or get paid programs. So, that you can figure and eventually file for your taxes on the web. Also, at the same time, you can make use of paper forms so that you can easily mail it to the IRS.

- Calculate your taxes, credits, and deductions – Tax law changes may influence your credits and deductions and the taxes you owe.

- Include your sources of salary, including pay, premium and investment income, and annuity or retirement accounts.

- Check in the event that you are qualified for education, family, and dependent credits for a qualifying child or relative.

- Check whether you meet all requirements for free tax return preparation – The IRS offers free tax help to individuals with low pay, military service members and their families, people with disabilities, seniors, and taxpayers with restricted English.

- You can also likewise employ a tax preparer to do your taxes for you

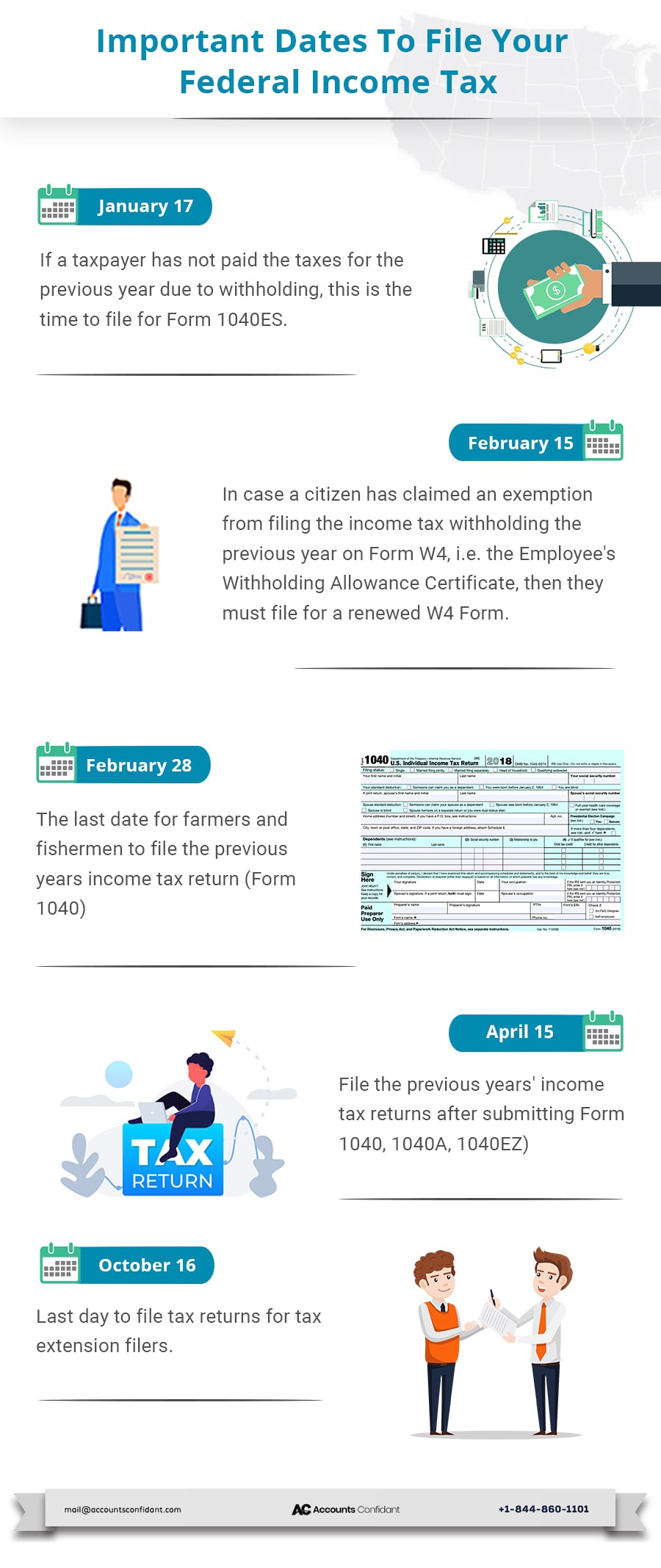

- File your taxes by April 15, 2019 (April 17 in Maine and Massachusetts).

How Can You Optimize Your Federal Income Tax?

The ultimate goal of filing taxes is to be able to optimize final tax amounts and to increase tax benefits.

In 2017 The Tax Cut and Jobs Act almost tried to readjust tax brackets, which reduced income tax rates for few individuals and other corporations. But the point is that no one knows where federal income tax rates will be heading towards in the future.

Always prepare and plan the taxes in advance. This helps you dodge the unnecessary penalties of late filing.

Here are some steps that you can take to optimize your Federal Income Tax:

- Assess What Part Of Your Income is Tax-Free: Certain earnings are not subject to tax deductions. These can include the home sale tax exclusion, saving funds on children’s education, municipal bond investments, receiving health insurance and some employee benefits.

- Benefit from Tax Credits: These can help reduce your taxes dollar-to-dollar. Whether it is something like childcare tax credits, education tax credits, home energy improvement credits, etc.

- Maximize the Deductions In Taxes: The formula for this is simple, apply more tax deductions for, lesser taxable income. Individuals who own businesses can get a waiver on their business expenses such as travel, operating costs, inventory, etc. In fact, if you own a small business, you can avail for a 20% pass-through tax deduction (maximum amount).

- Adjust Your Tax Rate: In case you want to have your income lie in a lower tax bracket, then show earnings from long-term investments. Examples of such are stocks, bonds, mutual funds, etc.

Wrapping Up:

Federal Income Taxes are common across the globe. We hope that with the help of this article, you were able to understand the different facets of it.

We at Accounts Confidant are not only your tax preparers and filers, but we are also your tax planners. Additionally, our team will help you to guide every step of yours in filing your federal income tax.

We analyze your business decisions strategically so that you get the most well-directed route for a stress-free tax season! We keep you ahead of your deadlines, and chart your form filling as well as credit analysis, to help you gain the maximum benefits.

If you have any questions around how you can file your federal income tax or are looking for a general heads up on the tax season, please feel free to call us today on our Toll-Free no. +1-866-301-2307 and have a conversation with one of our team of expert CFO’s!