If you are dealing with Federal tax matters, you may decide to represent yourself or have another person do it for you. The individual who represents you before the IRS must be authorized to practice law. You can name an individual or a team to work on your behalf through IRS form 2848, Power of Attorney and Declaration of Representative.

The objective of this article is to understand the procedure of filing the IRS form 2848. However, before we go through the steps of filling and filing the form 2848, let’s try and understand what it is and its purpose.

What is the IRS form 2848?

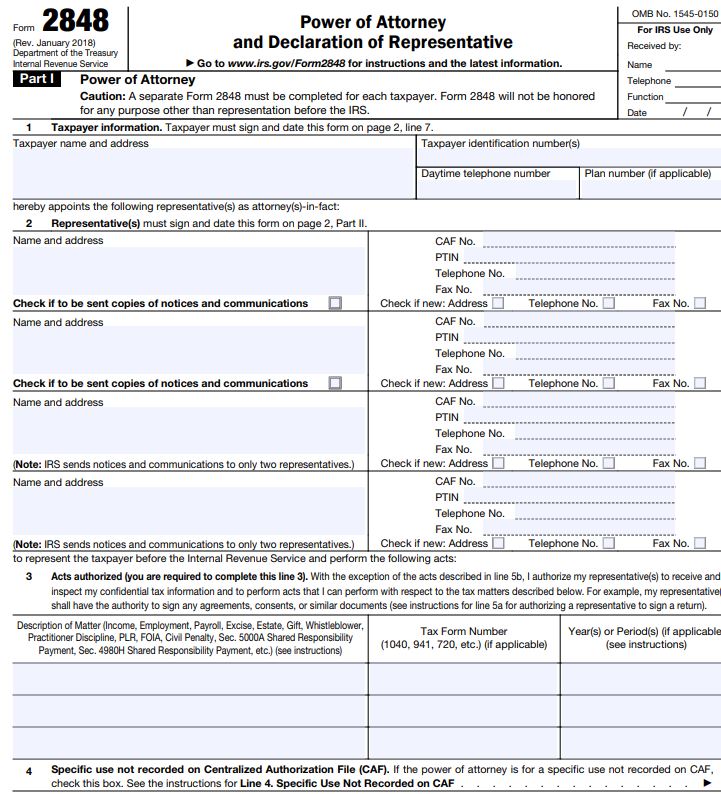

The form 2848 is the IRS Power of Attorney form, which grants an authorized individual authority to act on your behalf and represent you before the Internal Revenue Service. Once submitted, this form will grant an individual authorization to represent you before the IRS and allow the individual to receive and inspect confidential information about your taxes.

The form 2848 can be obtained by attaining the documents through a local tax office. The tax form is to be filed by the representative who is applying for power of attorney.

Read Also: How to file IRS Form 1040?

How to file the form 2848?

The following are the form 2848 instructions that you will need to perform in order to file it properly:

For Boxes 1 to 5

- Firstly, in box 1, the taxpayer who is giving power of attorney must provide the following: their name, address, social security number, employer identification number (if a corporation), daytime phone number, and plan number.

- Secondly, in box 2, the one assuming the power of attorney must provide their information. Now, there are cases where numerous parties that want to assume the power of attorney. In such instances, each party must provide their information. They must mention their name and address, followed by the CAF number, telephone number, and fax number.

- In Box 3, you must mention your tax form issues, tax matters, and the specific dates in which the power of attorney is granted.

- Box 4 should only be filled for any specific use that has not been listed on CAF. If the power of attorney is for a specific use not recorded on CAF or a specific-issue grant of authority to a representative, only then will you fill this box up.

- In form 2848, box 5 provides the universal definition of the power of attorney. This box also has sections for deletions and additions to allow the taxpayer to explain the powers and limitations of their attorney. If the form is fine as it is then there is no need to fill out this box 5.

For Boxes 6 to 9

- Next, you’ll move on to Box 6. The box clarifies whether or not the taxpayer will allow the representing party to receive tax refund checks but not to cash them. Now, if that is what you want then you must sign this box.

- Now, the purpose of boxes 7 and 8 is to inform you about the communications allowed to your power of attorney. These boxes also allow you to keep any previous power of attorney filings in effect. Most likely you will not want previous powers of attorney to remain in effect, but if you do you must attach those documents with the form.

- For box 9, the taxpayer must certify the form 2848, providing a signature and tax pin number. If the power of attorney is given for a joint tax return, both parties must sign off on the power of attorney in order for the Form 2848 to be effective.

- The representative must declare their status in part II and certify the declaration with their signature.

- Once completed, the form is ready to be submitted to the IRS.

Where to file form 2848?

If you are wondering “where to fax form 2848?” or “where to mail form 2848?”, the following information will help you in handling that:

If you reside in the following states–

- Carolina, Tennessee, Vermont, Virginia, or West Virginia.

- North Carolina, Ohio, Pennsylvania, Rhode Island or South Alabama.

- Arkansas, Connecticut, Delaware or District of Columbia.

- Florida, Georgia, Illinois, Indiana or Kentucky.

- Mississippi, New Hampshire, New Jersey or New York.

- Louisiana, Maine, Maryland, Massachusetts or Michigan.

Then, you will need to fax or mail your form 2848 to the following address–

- Internal Revenue Service, 5333 Getwell Road, Stop 8423, Memphis, TN 38118

The fax number for this address is –

- 855-214-7519

If you reside in the following states

- Nevada, New Mexico, North Dakota, Oklahoma or Oregon.

- Kansas, Minnesota, Missouri, Montana or Nebraska.

- Alaska, Arizona, California, Colorado, Hawaii, Idaho or Iowa.

- South Dakota, Texas, Utah, Washington, Wisconsin or Wyoming.

Then, you will need to fax or mail your form 2848 to the following address–

- Internal Revenue Service, 1973 Rulon White Blvd., MS 6737, Ogden, UT 84201

The fax number for this address is –

- 855-214-7522

If you reside in the following areas–

- All APO and FPO addresses or American Samoa.

- Non-permanent residents of Guam or the U.S. Virgin Islands.

- Puerto Rico (or if excluding income under Internal Revenue Code section 933).

- If you are a U.S. citizen residing in a foreign country filing Form 2555, 2555-EZ, or 4563.

Then, you will need to fax or mail your form 2848 to the following address–

Internal Revenue Service, International CAF Team, 2970 Market Street, MS: 4-H14.123., Philadelphia, PA 19104

The fax number for this address is –

- 855-772-3156

- 304-707-9785 (Outside the United States)

Problems that you could experience whilst file the IRS form 2848

The following are some instances where your form might get rejected:

- Sometimes the form 2848 is rejected by the CAF Unit if your form is incomplete. It is possible that you might have missed out on one of the steps on the form. So, you will have to ensure that every box of the form is properly filled out.

- In some instances, the CAF Unit rejects a perfectly valid Form 2848 because they believe that your signature appears to be a copied or stamped. Illegibility of a name or date can also cause rejection, even if it’s the fax that causes the illegibility.

- Failure to notify on time can cause your form to get rejected. The delay in the notification can hinder effective client representation on your behalf. Therefore, your form will be considered ineligible for acceptance.

In conclusion

We hope that the aforementioned article has helped you in gaining a better understanding of what the form 2848 is and how to file it. In case you still have any further queries regarding this topic or require assistance with filing the form, feel free to contact our experts at Accounts Confidant.