Every year, a huge number of Americans file their tax returns. A good number of them find out that they owe the government a big amount of income tax. Usually, it is more than they can afford to pay immediately. Moreover, many taxpayers owe back taxes and have no idea how they can pay those extraordinary amounts. However, there is no need to fret. The Internal Revenue Service (IRS) has come out with the form 9465.

The IRS form 9465 enables you to pay taxes in monthly installments. This is extremely helpful as you won’t have to pay it back in a large, one-time, lump-sum amount. Now, in order to qualify for this agreement, you will need to file all past tax returns.

Wondering how any of this works? Read our article to find out as we explain what the form is and the form 9465 instructions to file it.

What is form 9465?

The form 9456 is an IRS document used to request an installment agreement for paying off any owed taxes. Your payment plan should be requested out of necessity, especially if you cannot pay your taxes in full within 120 days of the tax deadline. For most installment agreement, you must pay your tax liability within three years.

If you owe less than $10,000, your monthly payment plan will be automatically approved by the IRS. But, during the previous five years, you must have:

- Filed your tax returns on time

- Paid any owed taxes on time

- Started no other installment agreements

You are also eligible to apply online if you owe less than $50,000. If you owe more than that, you need to file the form on paper along with Form 433-Fattached to it. Don’t forget, until your debt is completely paid off, you will be charged a compounding interest rate. In addition to interest, you will also be subject to late-payment penalties.

Note: You cannot use the IRS form 9465 if:

- You’re an active business owner who owes employment or unemployment taxes.

- You are in bankruptcy, or the IRS has accepted your offer-in-compromise.

- You have an existing monthly payment plan with the IRS.

If you are confused about the aforementioned situation, then feel free to contact our experts at Accounts Confidant.

How do I file form 9465?

The following are the steps that will help you in filing your IRS form 9465:

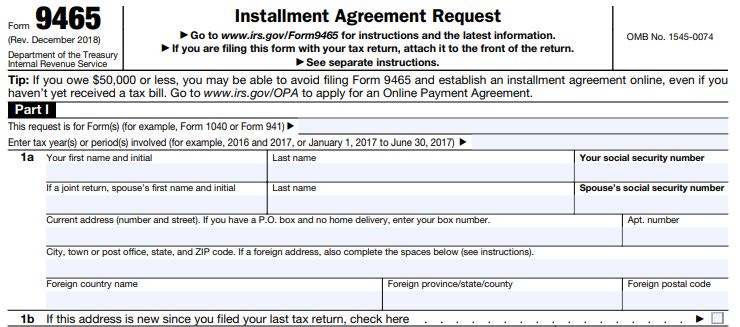

- Firstly, write the type of tax form you filed and what year that form was from on the small line directly above Line 1 of the form.

- Then, write the name or names of the tax filers on line 1 exactly as they appear on your Form 1040. If you filed a joint return, you must include both your name and your spouse’s name and both Social Security numbers.

- Next, add your current address and phone numbers at both work and home on lines 2, 3 and 4.

- Now, fill in the name and address for your bank or other financial institution of choice on line 5 and your employer’s name and address online 6.

- For the next step, enter the total amount you owe for the tax year on line 7.

- On line 8, enter the amount of the payment you are including with the installment request or made when you sent in your form 1040 if it was sent separately.

- On line 9, enter the amount that you are willing to pay each month towards your tax liability.

- Decide the day you want to make your payments for each month. You can choose any day from the first day of the month through the 28th. Write the chosen date on line 10.

- Enter your bank’s routing number and your account number on line 11. If you would rather send the IRS a check each month, leave line 11 blank.

- Finally, sign and date the form. Attach this form to the front of your form 1040 if you are sending the form immediately when filing your taxes.

Setting Up an Installment Plan

The IRS does not allow taxpayers to establish installment plans for free. A one-time setup fee is also charged. The amount depends on how you pay. Here’s how the IRS website describes the options:

- $31, if you set up an online payment agreement and make your payments by direct debit

- $107, if you don’t set up an online payment agreement, but make your payments by direct debit

- $149, if you set up an online payment agreement but don’t make your payments by direct debit

- $225, if you don’t set up an online payment agreement and don’t make your payments by direct debit

Methods of Payment

There are various strategies for an installment that are accessible. You can send individual checks, clerk’s checks or cash orders. You can even charge cash legitimately from your financial balances or pay with Visa. The electronic government charge installment framework may likewise be utilized (this requires a different enrollment).

Nonetheless, a key factor to recall is that the installment should be made by the end of every month. Installments might be made between the first and 28th of every month. On the off chance that the understanding stipulates that the citizen must make the installment by the fifteenth of every month and installment isn’t settled on, at that point the understanding is promptly viewed as in default.

Along these lines, the individuals who pay with a money order or cash request are encouraged to mail in their installments at any rate seven to 10 business days before the due date to guarantee a convenient receipt. Be that as it may, the IRS has now overhauled its site to enable citizens to adjust their portion understandings on the web.

People would now be able to overhaul their installment dates and even the conditions of their understanding, including strategy for installment and different subtleties. Approved agents can likewise get to the site and do this in the interest of their customers.

Where to mail form 9465?

All individual taxpayers who mail the IRS form 9465 separate from their returns and who do not file a form 1040 with Schedule(s) C, E, or F, should mail their form to the address for their state to the address that is provided below.

If you live in the following state:

- Alabama, Florida, Georgia, Kentucky, Louisiana, Mississippi,

- North Carolina, South Carolina, Texas, Virginia

Then you must mail to the following address:

- Department of the Treasury

Internal Revenue Service

P.O. Box 47421 Stop 74

Doraville, GA 30362

If you live in the following state:

- Alaska, Arizona, Colorado, Connecticut, Delaware, District of Columbia,

- Hawaii, Idaho, Illinois, Maine, Maryland, Massachusetts, Montana, Nevada,

- New Hampshire, New Jersey, New Mexico, North Dakota, Oregon, Rhode Island,

- South Dakota, Tennessee, Utah, Vermont, Washington, Wisconsin, Wyoming

Then you must mail to the following address:

- Department of the Treasury

Internal Revenue Service

310 Lowell St. Stop 830

Andover, MA 01810

If you live in the following state:

- Arkansas, California, Indiana, Iowa, Kansas,

- Michigan, Minnesota, Missouri, Nebraska, New York,

- Ohio, Oklahoma, Pennsylvania, West Virginia

Then you must mail to the following address:

- Department of the Treasury

Internal Revenue Service

Stop P-4 5000

Kansas City, MO 64999-0250

If you reside in:

A foreign country, American Samoa, or Puerto Rico (or are excluding income under Internal Revenue Code section 933), or use an APO or FPO address, or file Form 2555, 2555-EZ, or 4563, or are a dual-status alien or nonpermanent resident of Guam or the Virgin Islands.

Then you must mail to the following address:

- Department of the Treasury

Internal Revenue Service

3651 South I-H 35, 5501AUSC

Austin, TX 78741

Note: Permanent residents of Guam or the Virgin Islands cannot use form 9465.

In conclusion

We hope that this article has provided you with a better understanding of what the 9465 form is. If for any reason, you are facing difficulties with acquiring the form or filing it, please contact our experts at Accounts Confidant. We will ensure that your form is filled properly and mailed to the right address.