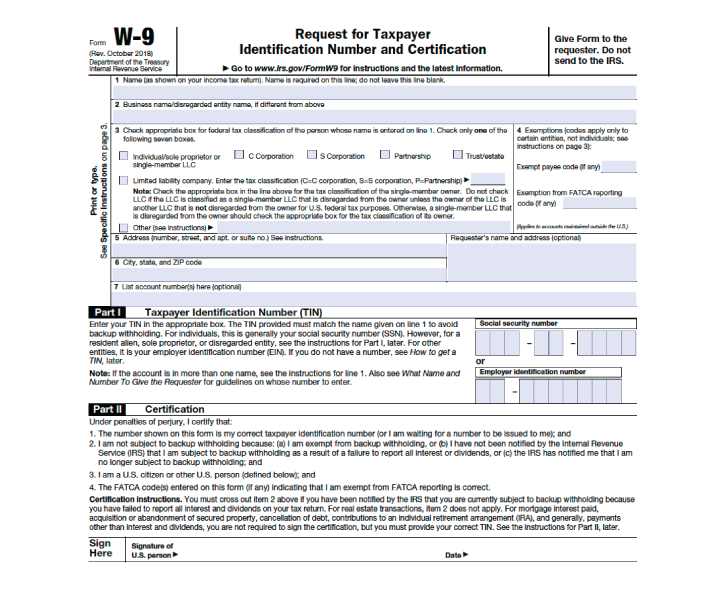

Form W-9 is a very basic IRS form having only one purpose. It allows you to communicate your Tax Identification Number (TIN), which is also known as your Employer Identification Number (EIN) or Social Security Number (SSN), to another individual, bank, or financial institution. The W-9 is a simple “information return,” which means it’s only for giving someone else information they need (rather than the IRS). However, because you aren’t sending it to the IRS, you must be cautious about who you send it to. The IRS W-9 form is used to avail Accounts Payable Services and Bank Reconciliation Services so you should be careful of sending your details to someone.

Here’s what to watch out for while filling out a W-9 form.

What actually is form W-9?

Persons and organizations utilize IRS Form W-9, Request for Taxpayer Identity Number and Certification, to send the correct taxpayer identification number to other individuals, clients, banks, and financial institutions. When you’re a self-employed contractor, you often send it to someone who will subsequently send you Form 1099, which you must submit to the IRS if someone paid you more than $600 this year. The IRS does not receive Form W-9.

Who has to fill out a W-9?

There are four common scenarios in which you may be obliged to fill out a W-9 form and deliver it to someone:

- You’re a contractor, freelancer, or consultant who expects to earn more than $600 from a single client throughout the tax year. Before they can send you a Form 1099-MISC, they’ll need you (the payee) to send them a completed W-9 form. You’ll need it to file your taxes with the IRS.

- When you open a new account with a bank, they may also want a W-9.

- Your bank or financial institution may also require a completed W-9 form from you in order to submit one of the other types of 1099 forms, which they’ll use to record things like interest income, payouts, and real estate transaction proceeds (i.e., if you sell your house).

- If someone forgives or cancels a debt you owe them, they must report it to the IRS on Form 1099-C. To finish the process, you’ll need to send them a completed W-9 form.

If someone other than a client, bank, or other financial institution requests a W-9 form, you should be hesitant to send one. This type of data can lead to identity theft and should be safeguarded accordingly.

What is backup withholding?

If the IRS has informed a contractor that they are subject to “backup withholding,” the firms paying the contractor’s invoices must withhold and remit income tax at a fixed rate of 24% from the invoice.

Contractors must mention on their W-9 if they are subject to backup withholding. Check out this IRS page to learn more about who is subject to backup withholding.

When you should NOT send someone a W-9

These are some of the instances when you should not send a W-9 form to someone

If You get one from someone you’ve never met before.

If you’re a contractor and you get a Form W-9 from someone who isn’t a customer, you shouldn’t fill it out. It could be risky to send your Social Security number (SSN) and other personal information to a stranger. Scammers will occasionally mail W-9s to unwary people in order to obtain their Social Security numbers.

If you have any doubts regarding a W-9 that someone has sent you, inquire as to which tax forms they intend to return to you once you complete it out. Consult a tax specialist if you can’t obtain a straight answer. Remember that the only reason anyone would ever need your W-9 is to mail you an IRS form.

Employers should not ask you for a W-9 if you receive one from them. Form W-4 is the correct form for them. If your company gives you a W-9 instead of a W-4 when you start full-time work, it could signal you’ve been employed as an independent contractor rather than an employee, and you’ll be responsible for tax payments to the IRS.

What’s the best place to get one?

If your customer, bank, or other financial institution requires you to fill out a W-9, they must send it to you. If you believe you need to fill one out, it is most likely already on its way. It’s also available in PDF format on the IRS website. You can also get an IRS W-9 form pdf over the internet.

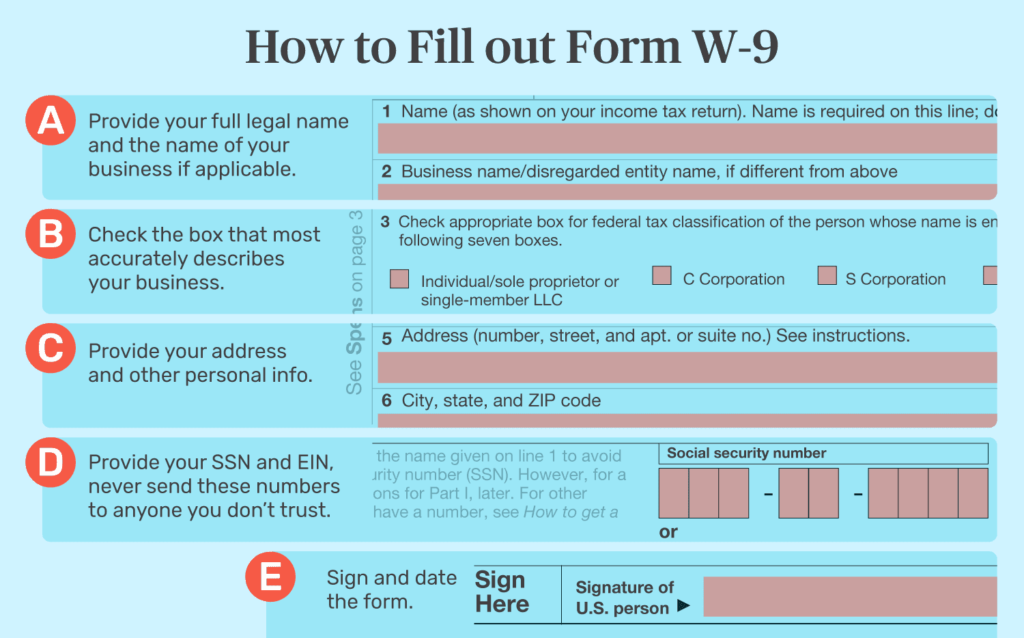

How do I complete form W-9?

The section at the top with information is as follows:

- Type your entire legal name (as it appears on your tax return) in the box below.

- If you have a business name (or a fictitious entity name), list it here.

- “Federal tax classification” is a fancy term for “how your company files its taxes.” By ticking the relevant box in this section, you must report what form of business entity you are for tax reasons. There are seven options available to you:

- Single-member LLC (sole proprietorship). You’re presumably a sole prop if you’re in business, don’t have a business partner, and haven’t incorporated your company.

- It’s a C corporation. A C corporation is one that has shareholders, a board of directors, and pays taxes independently from its owners.

- S stands for “small business.” You’re presumably a S corp if you’re an incorporated flow-through entity (i.e., you only pay taxes once, rather than twice like a C corp).

- Partnership. You’re probably in a partnership if you’re unincorporated and own your business with one or more other persons.

- Trust/Estate

- Limited liability corporation (LLC). You’re probably an LLC if you act like a corporation in your state but are taxed like a partnership or sole proprietorship on the federal level. Because an LLC is a “disregarded entity,” it can be taxed as a C corporation, S corporation, or partnership. To specify which one applies to you, write C, S, or P in the box.

- Other. This is for anyone filing from outside the United States. Check out the IRS’s guidance to international business entities if you’re an international business entity unsure how to integrate into the American system.

5-6. Fill up the blanks with your contact information.

- The account number(s) section only applies if you need to transmit the receiver of form W-9 account information (such as a brokerage account). If you’re unsure, contact the person who requested the W-9 form from you.

When should I send W-9?

If you’re asked for a completed Form W-9, it’s most likely because they’ll use it to send you a Form 1099, which you’ll need to record certain types of income to the IRS. Nonemployee compensation (1099-NEC), miscellaneous income (1099-MISC), dividends (1099-DIV), and debt cancellation are all instances of payments that need a Form 1099. (1099-C).

Also Read: What is IRS Form 8822?

Although there is no set deadline for submitting your W-9, you should do it as soon as possible. If you complete form W-9 as soon as possible, you will receive your tax forms as soon as feasible. Remember that failing to send someone a W-9 or sending one with incorrect information might result in a $50 perjury penalty. Double-check that your W-9 form is complete.

Conclusion

It might seem tricky to fill out a W-9 form so you can always reach out to various bookkeeping services to make it easier for you.