Every employee serves as a pillar for your business; those pillars take it to a high pedestal and mark its presence in the market. Those pillars include the sales team, a bookkeeper, Research & Development, & others as well.

Bookkeeping is done by every business with an aim that the financial records remained streamlined with the source documents.

Every invoice and bills should be fed into the system so that proper records are generated.

Timely reminders are sent to the concerned parties for the late payments.

Your monthly bills are paid on time.

These are the activities undertaken by a bookkeeper.

Relevance the Bookkeeper Holds in the Business

Budget Formation

Every company formulates budgets, so the bookkeeper assists in the formation of budgets, for various timelines – monthly, quarterly or yearly terms.

Tax Preparation

Tax season comes every year! It would be good if you are prepared for it beforehand, and this can be achieved by the support of the bookkeeper.

Business Analysis

A bookkeeper will help your business in the analysis of the various departments; they can assist you in managing your business cash flow. They will advise you that which of your business line is profitable and which one is not.

Better Decision Making

A business takes various decisions depending on the opportunities available out of which the positive decisions should always be welcomed.

The bookkeeper will help you in taking expansion or investing decisions, as they have all the information about your financial records – mainly of cash flow.

Track Profit and Growth

The bookkeeper furnishes you with the income statements and balance sheet, which is a good measure to judge whether your business is earning profits or not. Then, you can track how much profits or losses your business has made during a period.

Requirement Under Law

The bookkeeper will submit your taxes & manages payroll as per the IRS guidelines. From the basic form-filling to the furnishing the correct amount details into the form.

Payroll handling is an important task performed by it so that every employee can get the salary on time.

Duties of a Bookkeeper

Below discussed are the duties of a bookkeeper in brief:

Data Entry

In business, a number of transactions occurred in a day – related to bank, vendors, and inventory, etc., which generates bills and invoices.

The bookkeeper does all the work related to the data handling – every invoice & bill is fed into the system without any error.

It has to witness that no wrong data is captured, and if there is any, then proper measures are taken to solve it.

Financial Records

The bookkeeper has to prepare financial data from the journal entries. From a tiny bit part, they furnish the whole income statements & balance sheets to you.

Payment Reminders

The on-time reminders should be sent to the concerned parties on time so that there is no much delay of the payments.

When Your Bookkeeper Quits!

Report of U.S. Bureau of Labor and Statistics states: Employees are only staying in a job on average for 1.5 years, so retention is getting harder all over.

What would happen if your bookkeeper hands over their resignation letter to you? Do you have a backup to pick up from where that person left? Do you have written policies and procedures for all of your business’s bookkeeping and accounting?

These questions trigger the fact that you must evaluate the role of a bookkeeper in your financial operations; generally, a phase to evaluate your financial processes.

When a bookkeeper quits, there might be a backlog of data entry piled up which is left behind. This can be handled in below manner:

- Either you have a backup of bookkeepers

- Or you have online bookkeeping services

Backup of a Bookkeeper

In a small business, it is difficult to hire a team of bookkeepers; there is a maximum of 1 or 2. And when one bookkeeper quits, the other one should handle the piled-up work.

But there is a limit to which your other bookkeeper can handle the work. And what if the other one also quit?

These questions put the businessman into a thinking process, how much backup of bookkeepers is required to sustain in business.

When a bookkeeper quits, many business secrets go out with him. It knows of every account detail of you; transaction amount; where you deal etc.; having the inside business information is menacing – a breach of information.

A bookkeeper quitting can expose inefficient and outdated financial processes that can actually cause your business significant financial loss.

It would be essential to safeguard your data, as the bookkeeper can mistakenly or deliberately delete it.

It would be better if you have a condition in your company’s policy that – no business secrets shall be open to the outside world.

Online bookkeeping services

When your business opts for the online bookkeeping services, the benefits it gets are immense:

Security

There is always a stamp of security in online bookkeeping services. Your data is not prone to any leaks or cyber-attacks.

The financial data is very sensitive, which should be protected in all the ways. Keeping this in mind, the virtual accountants always aim to safeguard your data from any unfortunate events.

Time-Saving

You can leave the worry of checking your accounts to online bookkeeping services. In that time saved, you can utilize it in handling other business activities.

You should always go through your books with your bookkeeper, but there can be times when you are unable to do it. In that phase, a “sense of worry” starts to build-up.

But when you have online bookkeeping services, the worry phase drops to 0, as all of the matter is an expert’s hands.

Economical

These services are proved to be economical to the business, as you have to only the agreement price, and not more than. Comparing it with your in-house bookkeepers, considering various costs related to it, this one is beneficial in every term.

The online bookkeeping services will offer you the best services at a lesser cost (generally, 60% less than the in-house bookkeepers).

No Data Breach

There will be no data breach, when a bookkeeper from online bookkeeping services quits, as it is not physically or emotionally attached to the business.

As there is a security feature, so your data is nothing anywhere; it is always in safe hands.

Data Stored

Your data is perfectly secured in different media simultaneously, as the transactions happen. So, there is no worry about data loss.

You can avail the data anytime from the virtual accountants if you have lost it from your end.

Procedure to Follow When Your Bookkeeper Quits

The termination phase can be deal in 3 phases:

Pre-termination phase

- Call a discussion with your bookkeeper immediately, and ask all the important information from it.

- Request an immediate release of all the information & documents under its supervision.

- Obtain all the spreadsheet, docs, etc. Make sure to verify the contents.

During the termination phase

- Every supervisor must know about the resignation or termination of the bookkeeper. Pass on the information to every supervisor of your company.

- Set a meeting with all of your employees and tell them about the termination\resignation.

- Lastly, make sure you change every password, which it had under him.

After the termination phase

- Prepare complete paperwork of the individual, including relieving letter and full & final settlement.

- Drop a message to every staff, as well as to the clients.

- If possible, change the passwords of the online accounting system.

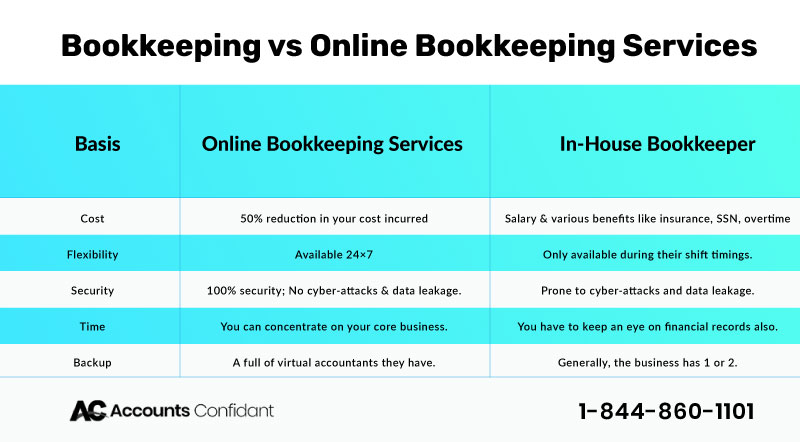

Bookkeeping vs Online Bookkeeping Services – Which one is the best?

Considering the advantages that online bookkeeping services provide over bookkeeping, you should go with the former one.

The former gives benefits in cost, security, time, and most importantly, there is no data breach. On the other hand, the latter gives these benefits, but at a lesser pace.

The main difference which apart both of them – when your bookkeeper quits, you have to hire another one. But in online bookkeeping services, when a bookkeeper quits, they have a full team behind it which gradually means the bookkeeper did not quit.

The virtual accountants are not involved emotionally in your business, but on the other hand, an in-house bookkeeper can leak your secrets to your competitors.

It would be advisable to go with online bookkeeping services, irrespective of the size of your business.

Conclusion

After going through the whole blog, a final recommendation would be given to online bookkeeping services over the bookkeeping.

All the considerations are made on benefits provided by both to the business. A prominent online bookkeeping service can offer your business to an accurate record of financial statements. You can directly contact our Certified Bookkeepers at +1-866-301-2307.