Whether you are thinking about starting a business or changing the structure of your business, one of the most important decisions you will have to make is to choose whether to structure the status of your business as an S corporation (S corp) or a C corporation (C corp). The most significant S Corp Vs C Corp is how they handle taxes differently.

The objective of this article is to help you gain a better understanding of the difference between S and C corp and help you decide which structure would suit your business better. However, before we go through the points that will help you discern between both the corporations, we must first understand what they both are.

“S corp” which stands for “Subchapter S corporation” is a special tax designation that is granted by the IRS. This enables corporations to pass their corporate income, credits, and deductions through to their shareholders. This means that the corporations themselves don’t pay any income taxes. Instead, the company splits up the income amongst individual shareholders. Then, the shareholders pay it personally on their own tax returns.

On the other hand, a “C corp” is a type of company that is owned by shareholders. The shareholders elect a board of directors, who decide how the company runs. This means that legal and financial responsibility lands on the shoulders of the corporation, not the owners. C corps pay tax at a special corporate tax rate which is different from individual tax rates.

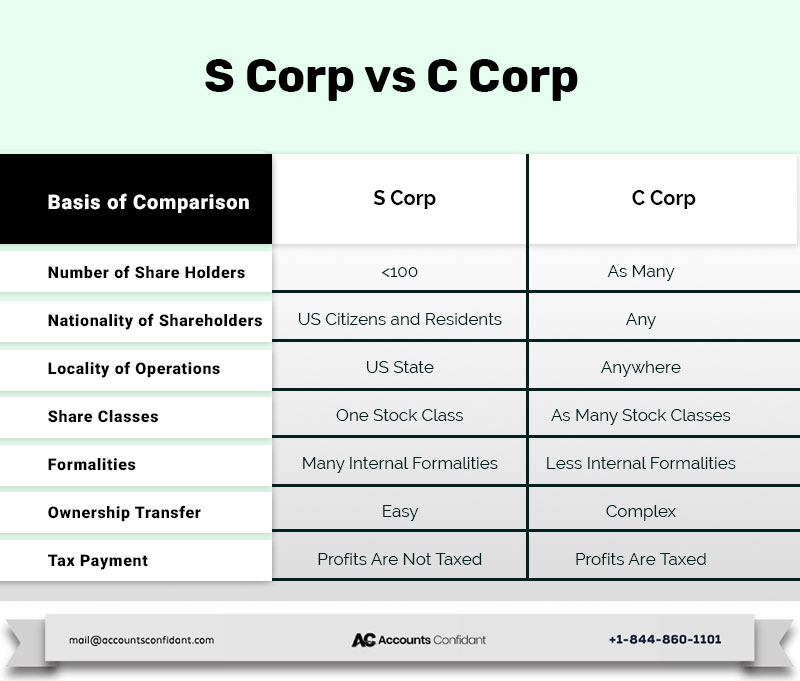

Now, let’s dig much deeper into the points that emphasize the difference between S Corp and C corp.

The difference between S corp and C corp

The following are the various factors that will help you with the S corporation vs C corporation comparison:

S Corp vs C Corp: Differences in taxation

S corp: In an S corp you won’t have to face the aforementioned situation. An S corp is managed and looked at in a way that is similar to a partnership or a sole proprietorship. Your corporation passes the profits and losses of the S Corp to the shareholders. Then, the shareholders report these taxes on their personal tax returns.

For instance: If you have an S Corp, you won’t need to pay any corporation tax. The full $50,000 profit would pass through to you as a dividend. You would then pay the 20% personal tax rate on that, or $10,000. That would leave you with $40,000. This amount is $16,960 more than the amount you would leave within a C Corp.

C corp: C corporation profits are taxed and reported on the corporation tax return for federal tax purposes. Any after-tax profits are divided amongst the shareholders and taxed again. They are then reported by the shareholders on their personal tax returns.

For instance: Let’s assume that you are the only shareholder of your corporation. The corporation has a profit of $50,000. Then, your corporation would pay a tax of 28% (or $14,000). That leaves you with a dividend of $36,000. You would then pay personal income tax on the dividend. Assuming for our example, a tax rate of 20%, you would pay $12,960 and be left with $23,040.

In this aspect choosing an S corporation might seem more preferable as you can save on taxes.

S Corp vs C Corp: Differences in restrictions and limitations

S corp: Alternatively, S corporations have their fair share of restrictions and limitations. To begin with, you cannot have more than 100 shareholders in an S corporation. Furthermore, all the shareholders must be citizens or residents of the US. S corporations give all their shareholders equal voting rights and are limited to one class of stock. On top of that, some types of businesses are not eligible to become S corporations. These include banks and some insurance companies, among other types of business.

C corp: There are no shareholder restrictions for a C corporation, you can have as many as you want. You can also have different classes of shareholders as C corporations have the option to divide up voting rights by issuing different classes of stock. C-corporations levee no restrictions on ownership as well. Moreover, C-corps are open to foreign investors.

In this aspect, C corporations are usually a better choice for large businesses due to their greater flexibility.

C Corp vs S Corp: Differences information

C corp: C-corp is a default type of corporation. In order to turn your company into a standard C-corp, you will need to file articles of incorporation with your secretary of state. You will also need to appoint a registered agent and create corporate bylaws.

S corp: In order to elect an S-corp status for your company, you will need to file the IRS Form 2553. Once you have filed the form your corporation will become eligible for an S-corp status for federal tax purposes. However, if you want to be treated as S-corp for state taxes, you might have to file additional papers at the state level.

In this aspect, the preference completely depends on the needs of your company. Regardless of the status, you choose for your company, some of the same steps for a corporate formation will have to be followed.

C Corp vs S Corp: Differences in fringe benefits

C corp: The cost of benefits for health, life, and disability insurance can be deducted by the corporation for shareholders who are employees in a C corp. As long as the benefit is provided to at least seventy percent of the employees, these benefits are not taxable to the shareholder.

S corp: You do not have the option of deducting the cost of benefits in an S corp. If a shareholder owns more than two percent of the stock, their fringe benefits become taxable.

So, in this aspect, C corp would prevail as a better option since it provides more leeway to its shareholders when it comes to fringe benefits like the ones mentioned above.

In conclusion

We hope that this article has helped you in gaining a better understanding of the difference between C Corp and S corp or S-corp Vs C-Corp. We are certain that based on the aforementioned information, you will make the right decision for your company. However, if have any further queries regarding this topic, you can seek consultation from our experts at Accounts Confidant or leave a comment below.