Sales Tax Filing is to report financial information to the IRS. The idea is to do it timely, efficiently and keeping all the guidelines in mind. Compliances are of importance while filing taxes in order to avoid penalties. This article will talk about some specific tax forms like IRS Form 940, Form 941 and Form 944 and their planning, preparation, guidelines, and filing.

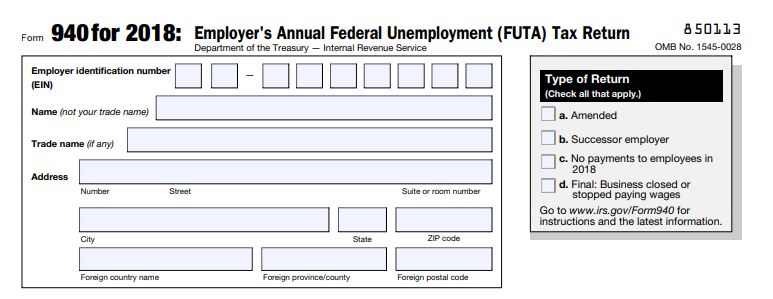

Form 940: This is the Employer’s Annual Federal Unemployment (FUTA) Tax Return. FUTA tax is stringently an employer-paid tax. Employees don’t have to pay for it. With the IRS it gets filed on an annual basis. It might be filed electronically.

Form 941: This is the Employer’s Quarterly Federal Tax Return. All employers are needed to withhold federal taxes especially from their employee’s allowances or compensation.

Form 944: This is the Employer’s Annual Federal Tax Return. It is only filed if in case you were informed by the IRS in writing to do so.

When you work in a new job your employer asks you to complete the Sales Tax Filing.

Now, the question arises—why?

- Sales Tax Filing helps in figuring the allowances that eventually gives you a clear view of your tax situation.

- Secondly, you can claim allotment for child and dependent care. It’s a money-saving tip.

We shall discuss in detail about each “Employment Tax Return Forms 940, 941 & 944. To begin with let’s start with Form 940.

Why Is Sales Tax Filing of IRS Form 940, 941 & 944 Important?

- One needs to have a clear insight as to how much federal income tax needs to be withheld?

- It is of high importance that you must abide by the federal and state annual and quarterly employment tax reporting with securities prerequisites.

- Needs to have a clear understanding with regards to where to send this money along with other employment taxes?

- To get a clear comprehension of the same it is imperative for you to file and refer to Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax; Form 941, Employer’s Quarterly Federal Tax Return; and follow the instructions also for Form 944, Employer’s Annual Federal Tax Return.

Let’s talk about the objectives!

- Generally speaking, employers need to file Form 941 usually on a quarterly basis.

- In the case of quarterly based securities, they might be required for taxes that are reported on IRS Form 940.

- Employers should file Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return on an annual basis. Seek more information, view the Form 940 Instructions.

- Apparently, those who are small-sized employers (whose annual liability that includes social security, Medicare, and withheld federal income taxes is $ 1,000 or is less for the given year) might be required to file Form 944, Employer’s Annual Federal Tax Return annually rather of Form 941.

- In fact, monthly or sometimes semiweekly securities may be needed for taxes disclosed on Form 941 (or Form 944).

IRS Form 940-

Pre-Requisites of IRS Form 940

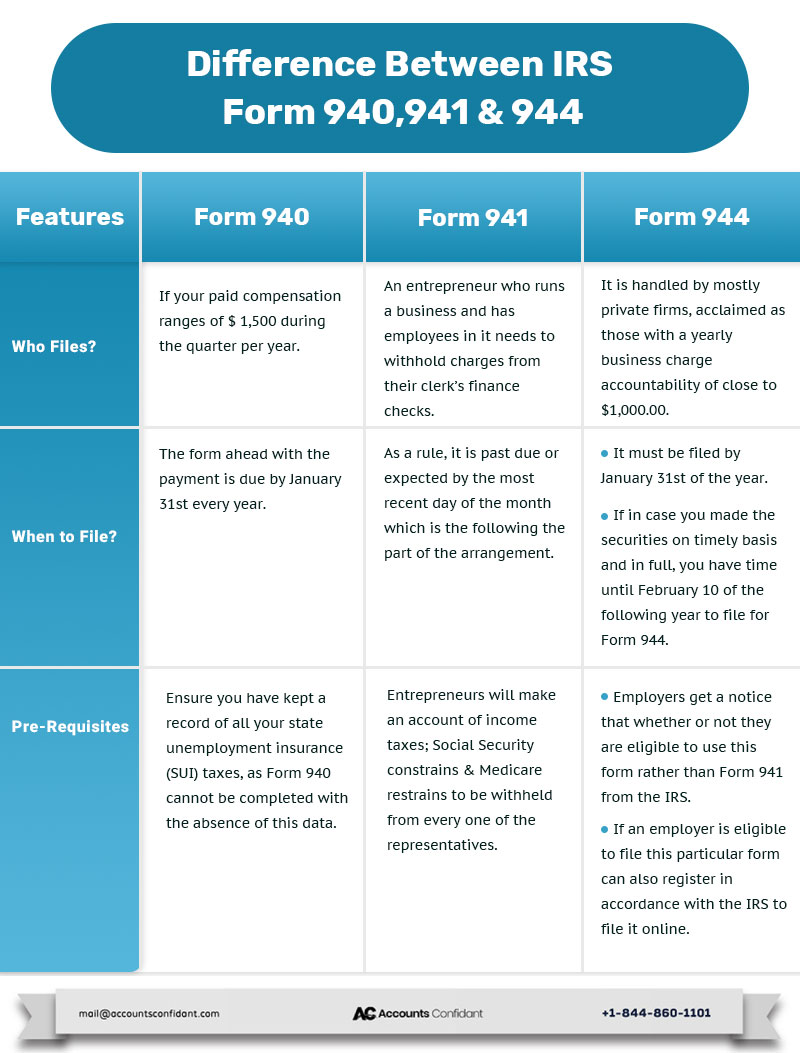

Prior to your document Form 940, make sure you have recorded all your state unemployment insurance (SUI) taxes, as Form 940 can’t be finalized without this data.

Who should file a 940 tax form?

- If you paid compensation of $ 1,500 or more to representatives in a logbook during the quarter of the year.

- If in case you had at least one representative for somewhat time of the day in at best 20 distinct weeks in both of the previous two years.

When should you ideally file tax Form 940?

- Form 940 typically covers a standard calendar year.

- The form along with the payment is in most general cases due by January 31st for the prior year.

How do you file IRS Form 940?

- You have multiple options like you can either file 940 tax forms online or simply mail it to the IRS.

- If you e-file, in this case, you must use a third-party and pay a fee.

- If you are in a thought process as to where to mail Form 940, the address that you will primarily use depends entirely on your business locality.

- You can avail more information on the mailing address in the IRS Form 940 Instructions.

IRS Form 941–

Pre-Requisites of IRS Form 941

In general, Form 941 needs an entrepreneur to account for the:

- number of workers

- From every representative sum, gets withheld

- all social security constrains

- all Medicare restrains

- Requires the entrepreneur to list any advances earned on salary accredits that paid out to representatives if they are relevant.

Who should for file tax Form 941?

- Any of those businesses that withhold charges from their workers finance checks and should round out a 941.

- There are two constitutional exceptions related to this form—The primary special case is for entities who have family representatives like “Specialists” or “Servants” as well as “Farmers”.

- Another exception here will be for a representative who doesn’t work on a regular premise.

- An entrepreneur will just be required to assimilate these representatives on their 941 if the representatives worked among that quarter.

When do you file tax Form 941?

Form 941 is in most general cases due by the last day of the month following the end of the quarter.

How do you file tax Form 941?

- Form 941 may be submitted electronically using Federal E-File.

- You can E-File Form 941 and pay any balance which is due electronically by using tax preparation software or with the help of consultation with a tax professional.

IRS Form 944–

Pre-Requisites of IRS form 944

- Listing of identical data on this form as they would on Form 941 by the employers.

- Unlike the quarterly documenting essentialities of Form 941. This form is recorded only once in every year.

- Employers receive a notice that whether or not they are eligible to use this form rather than Form 941 from the IRS.

- If an employer is eligible to file this particular form can also register in accordance with the IRS to file it online.

Who needs to file tax Form 944?

- Form 944 is handled by private firms, distinguished as those with a yearly business charge liability of close to $1,000.00.

- It was figured that businesses that paid earnings of under $4,100 will fall inside this association.

When do you file tax Form 944?

- Form 944 must be filed by January 31st of the year after the year being reported.

- If you have made deposits on a timely basis and in full payment, you have until February 10th of the following year to file this form.

How do you file tax Form 944?

- First of all, you can file this form physically.

- You can either take a print out of Form 944, fill it out manually, and mail it, or fill it out on your computer, print it, and mail it.

- The IRS Form 944 instructions designated to what location you can file this return.

- You can also file Form 944 electronically, you can make use of the IRS E-File

Streamline Sales Tax Filing Today: The Perfect Solution!

- Every now and then it is really difficult to manage your ledgers, keep a track of your books and accounting tasks on a daily, monthly and quarterly basis.

- As they tend to confuse many of the business owners at times due to half-knowledge and its extreme complexities. Therefore, why not get mess-free books, be efficient and get cost-effective Online Bookkeeping Services.

Conclusion:

In this article till now as readers, we have a substantially got a clear purview of an Overview of the “IRS Form 940, 941 & 944”. As, we discussed in detail each tax form to get a clear understanding as to when, why and how to file these forms as it is quite essential for many of the small to medium-sized-business corporations to file. We have understood the basic fact that when any company hires employees it is integral that you as an entrepreneur must adhere to federal and state annual and quarterly employment tax reporting and deposits prerequisites. So, the future is of “Virtual Bookkeeping Services” or “Online Bookkeeping Services” which gives you stress-free accounting tasks on a timely basis. Further, it helps you to streamline your business, as a result, you can in a way expand your core business operations. Here at Accounts Confidant, if in case you have any doubts pertaining to this above topic. Please don’t apprehend yourself to contact us on our Toll-Free +1-866-301-2307. Get assistance with one of our team of expert CFO’s and stay ahead!