Being a U.S. taxpayer you need to fill out different tax forms when you file your annual tax return. About a few forms you have a clear idea while some…

Learn More

Being a U.S. taxpayer you need to fill out different tax forms when you file your annual tax return. About a few forms you have a clear idea while some…

Learn More

Are you a U.S. taxpayer who is in the idle of the tax preparation process? If yes then in the process you must have heard of IRS Form 8821. At…

Learn More

Every business works for a profit motive. The business can earn profits by selling its products in two ways: Cash Basis (Cash Trade) Credit basis (or Outstanding Receivables) If you…

Learn More

If you are running a small business in the United States, then there are some necessary obligations that you will need to fulfill to duly comply with the rules prescribed…

Learn More

Forecast! Budget! On reading the two, you might be wondering how are they similar and where are they different. The terms have been used interchangeably, but we know that there…

Learn More

The first question that strikes here is how to choose the right accounting software for your business? This can get really confusing at times as there are plenty of products…

Learn More

Whether you are thinking about starting a business or changing the structure of your business, one of the most important decisions you will have to make is to choose whether…

Learn More

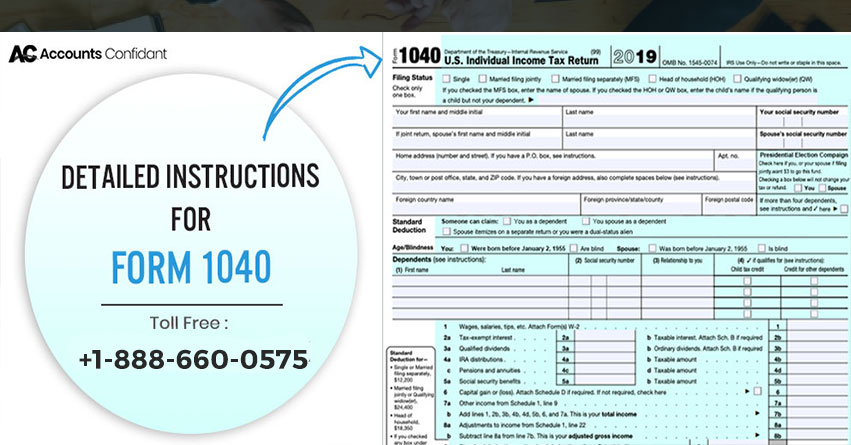

The IRS Form 1040 is one of the most common IRS tax forms. U.S. taxpayers use this document to file their yearly income tax return, claim tax credits and tax…

Learn More

Looking for help? Talk To Our Bookkeeping And Taxation Experts and Get Your Issue Solved!

Toll-Free: 1-844-860-1101