Tax season comes every year with lots of paperwork and mental pressure. If you haven’t got the opportunity to manage your books according to the upcoming tax season, then you…

Learn More

Tax season comes every year with lots of paperwork and mental pressure. If you haven’t got the opportunity to manage your books according to the upcoming tax season, then you…

Learn More

What is Bookkeeping? To provide you with a basic aggregative answer, the task of bookkeeping includes the systematic recording and organizing of financial transactions in a company and reconcile the…

Learn More

The Wage and Tax statement or the W2 Form is the form that the employer sends to all their employees and the IRS at the end of every financial year.…

Learn More

What is Income Tax? An income tax is a tax levied by the government, that is extended on businesses and individual incomes, spanning within a particular jurisdiction. Income tax is…

Learn More

What do we mean by Form 944? IRS Form 944 is outlined so the smallest businesses (those whose yearly risk for government disability, Medicare, and retained federal income tax range…

Learn More

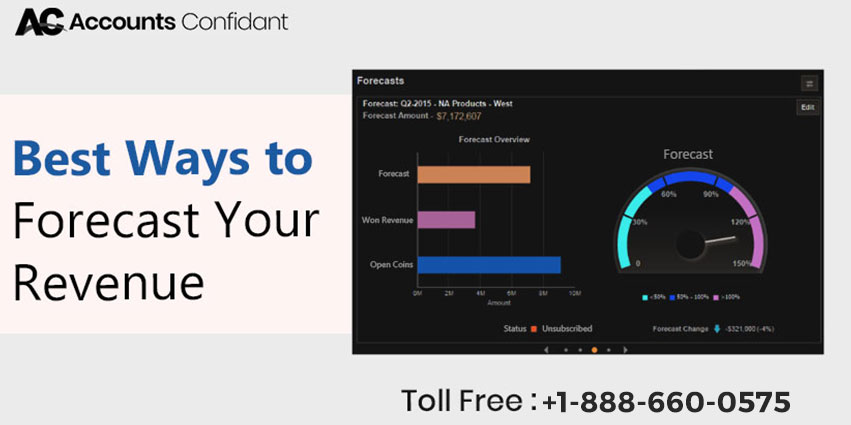

A business surely runs better with forecasting. That business runs smoothly which has forecasting in its planning foundation. With this said, let’s dive into our topic: How to Forecast Revenue!…

Learn More

Starting with the very basics, let’s understand what the core job of an accountant actually brings about. An Accountant is a trained expert who can prepare, keep track, and analyze…

Learn More

The first question that strikes here is how to choose the right accounting software for your business? This can get really confusing at times as there are plenty of products…

Learn More

Looking for help? Talk To Our Bookkeeping And Taxation Experts and Get Your Issue Solved!

Toll-Free: 1-844-860-1101