If your business is structured as a partnership, then you would have definitely heard of the “Partnership Tax Return” or the form 1065. This form gives the IRS a larger picture of your company’s financial status and position. This is the way that business partnerships report their profits, losses, deductions, and credits to the IRS. There is also an extension to form 1065 and that is Schedule K1. Like the former gives a picture of the partnerships relevant financial information, the latter is used to report each partner’s allocated profits and losses and goes as a part of their personal tax return.

| Another important point to note here is that the form 1065 is not reflective of the amount of tax a business owes to the IRS. All it shows are their total net income and their relevant financial information to the IRS. |

A point to note here is that a partnership is different from a corporation as it only reflects the business relationship between two or more individuals to carry on a trade.

Who Files the Form 1065?

All the entities that are listed as partnerships in the US are required to file form 1065. The following entities that come under the partnership agreement are required to file the form:

- If your company is an LLC, and all other domestic partnerships must file form 1065. These would include the entities whose headquarters are situated in the U.S.

- Foreign partnerships with earnings (more than $20,000 and 1% of their total income) in the U.S. need to file form 1065 as well.

- When it comes to non-profit religious organizations, they too need to file the IRS form 1065. This is because they are required to reflect that the profits were divided as dividends, regardless of whether they were distributed or not to the members.

Form 1065 Instructions:

Here is a complete guide of how to file form 1065. We will first walk you through the list of requirements and then the procedure.

Documents Required:

Documents required to file form 1065:

- Year-end financial statements like profit and loss statements.

- List of deductible expenses.

- Balance sheet covering the beginning and end of the year.

- The Employer Identification Number (EIN)

- The respective enterprise’s Business Code Number

- The total number of partners associated with the business.

- Initializing the date of the business.

- When the company makes use of either the cash or accrual method of accounting. The information needs to be mentioned on the IRS form 1065.

- In case the profits were paid to the company independently of the partnership relations. In such a scenario you will have to attach the form 1099 as well.

Documents required to file the Schedule-K1:

- The information furnished in the “income and expenses” section of the Form 1065.

- Real estate income

- Bond interests, royalties, and dividends

- Capital gains

- Foreign transactions and other guaranteed payments; all of which need to be received due to their involvement in the partnership.

Steps for filing:

- As mentioned before, this form is a reflection of the company’s financial status. Add to that, it also needs clarity on the partners and their specific stake in the company by percentage.

- Therefore, before you file Form 1065, you will be requiring information from the following sources:

- Depreciation and Amortization documents in the form of Form 4562.

- A complete cost of the goods sold as mentioned in Form 1125-A.

- In case there is any sale of a business property that has been mentioned in the Form 4797.

- Copies of 1099 by the business.

- The form 8893 that signifies an election of Partnership level tax treatment.

- Form 8918 and the material advisor disclosure statement.

- Receipt of certain foreign gifts and the annual return to report transactions in the form of the form 3520

- Once these are ready, you are in an informed position to start filing the Form 1065.

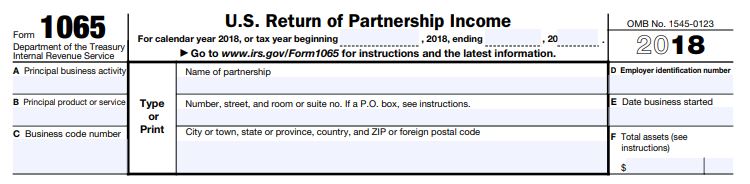

- You now need to fill the General Information section that will involve:

- Name of the partnership

- Address of the partnership

- Focal business activity and the Business Code Number

- Date of the business’ inception

- The used accounting method

- On the first page, you need to give information about the business’ income and the deductions on the partnership. The profit and loss statement comes in use for the same.

- You now need to fill the Form 1065 Schedule B; these are the second and third pages of the IRS for 1065. These include 25 questions that have Yes/ No as a response.

- Some questions are around the individuals that own 50% or more than that in the partnership.

- Secondly, some centers on the investment that the partnership has made.

- Question 8 focuses on whether the partnership has bank or investment accounts in countries outside the United States of America.

- In case there are individuals in the partnership that are foreign citizens, then you need to pay special attention to Question 14.

Note:There are additional Schedule L, M-1, and M-2 that are a part of Form 1065. If your partnership’s total annual receipts are more than $250,000 or the assets are more than $1 Million, then you need to fill out the Schedules L, M-1, and M-2. (They are located on page 5 of your IRS Form 1065.) Schedule L:– This is a balance sheet that details all of your business’ assets, liabilities and the capital so that the IRS is aware of your company’s financial position. Schedule M-1:– As it is normal and that there are discrepancies between what the partnership records as its net income on the books vs. what the IRS would see as actual taxable profits. However, the Schedule M-1 reconciles all such differences. Schedule M-2:– This informs the IRS of any changes that have occurred to you or your partner’s capital accounts. (This could be due to cash, property or other capital contributions.) However, the information in Schedules L and M-1 needs to match the items in Schedule M-2. |

Deadlines to File Form 1065:

For 2019, the deadline for the Form 1065 is March 15, 2020. Unless you have a 6-month extension, in that case, you need to file Form 7004 to extend your deadline to September 16.

Wrapping Up:

Form 1065 or the partnership tax return is essential to give the IRS a complete idea about the financial position of your business. Having a detailed knowledge of the Schedule K-1 is also important when you have to file your personal tax return. Additionally, we hope that the blog gave you a complete idea of what the form is, its complete list of instructions and respective deadlines.

If you too are planning on preparing your Form 1065 and need expert assistance, then you can talk to our team of tax experts at Accounts Confidant on +1-866-301-2307 and get started today.