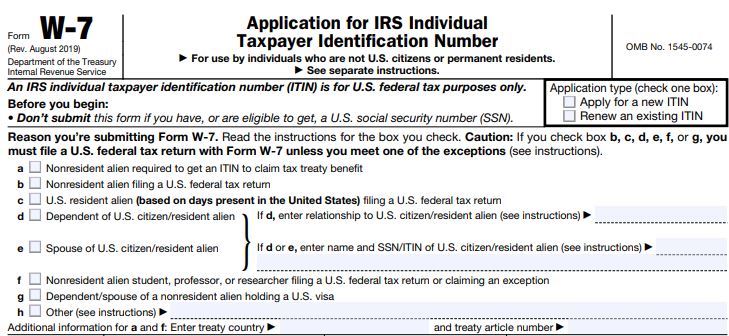

A W7 form is filled out for the specific purpose of attaining an Individual Tax Identification Number or “ITIN”. An ITIN is a number issued by the Internal Revenue Service (IRS) that you can use for the purpose of filing taxes. This number is issued to those individuals who are required to have a U.S. taxpayer identification number but are ineligible to obtain a Social Security Number (SSN) from the Social Security Administration (SSA).

The objective of this article is to explain to you what the W7 form is and how to file it. However, let us first try to understand what it is and the purpose it serves before we go through the procedure of filing the form.

What is W7 form and what purpose does it serve?

The form is used to provide the IRS with all the information that is required to verify the identity of a taxpaying non-citizen. Also, it’s used to have current contact information on file with the IRS. Many ITIN applicants wonder where to send W7 form information when it is completed.

The IRS began issuing ITINs in July of 1996. ITINs are issued because both resident and non-resident aliens may be required to file U.S. tax returns. Additionally, ITINs are used on individual income tax returns when claiming an exemption if one’s dependent or spouse does not have and is not eligible to receive an SSN.

The important thing to understand about the W7 form is that it is designed to collect the same kinds of information the IRS needs from any individual with taxpaying obligations in the U.S. It simply provides an alternative framework for those who do not qualify for Social Security to accurately and easily file tax returns and make tax payments.

The process provided by ITIN W7 Application is designed to provide you with a streamlined way to assemble all the information you need with an easy online resource. Start by reading through the ITIN application page, and then from there it’s as easy as putting together the materials you need to mail in after you complete the easy-to-access paperwork online.

Note:

- The deadline to submit your W7 form is December 31, 2019, as your ITIN will expire on that day.

- The ITIN is for federal tax purposes only. It does not entitle you to social security benefits and does not change your immigration status or your right to work in the United States.

- Also, individuals filing tax returns using an ITIN are not eligible for the earned income credit (EIC).

- Individuals filing tax returns using an ITIN are also not eligible for the making work pay and government retiree credits (unless filing a joint return with a spouse who has an SSN).

- Do not fill up the W7 form if you have an SSN or you are eligible to obtain an SSN. You are eligible for an SSN if you are a U.S. citizen or if you have been admitted by the United States for permanent residence or U.S. employment.

- If you have an application for an SSN pending, do not file the W7 form. Complete W7 form only if the SSA notifies you that an SSN cannot be issued.

- If the SSA will not issue you an SSN, a letter of denial must be obtained and attached to your W7 form. This applies whether you are attaching your federal tax return or requesting an ITIN under one of the exceptions.

Steps to fill out the W7 form-

You will need to perform the following steps in order to fill out your W7 form:

- Firstly, you must affirm that all information is accurate and matches your supporting documentation.

- Then, you will need to fill-up the form through an Online Application.

- Include your original federal tax return(s) for which the ITIN is required. Attach the W-7 PDF we send to you via e-mail, to the front of your tax return

- Leave the area of the SSN blank on the tax return for the person applying for the ITIN

- Include your original document(s) or certified copies.

- If you are applying under an “EXCEPTION” make sure to review the tables and include any additional required documentation for your particular exception.

- Send your packet (W-7, 1040 tax return, and Documentation) to the IRS.

For ITIN Renewal Applications:

- Verify that all information is accurate and matches your supporting documentation.

- You’ve completed the W-7 form through the Online Application.

- Include your original document(s) or certified copies.

- Send your packet (W-7 and Documentation) to the IRS.

If the whole process seems tedious or difficult to follow through with, you can reach out to us on our toll-free number +1-888-660-0575. At Accounts Confidant, we assist you in filling up filing your w7 forms.

Where to send the W7 form?

For both New and Renewal ITIN applications, Mail All packages using USPS (United States Postal Service) to:

Internal Revenue Services

ITIN Operations

PO Box 149342

Austin, Texas 78741-9342

If you choose to use a different parcel service (FedEx, UPS, etc.), use the following address:

Internal Revenue Services

ITIN Operations

Mail Stop 6090-AUSC

3651 S Interregional, Hwy 35

Austin, Texas 78741-0000

Common errors to avoid while filling the W7 Form

The following are some errors that you could make whilst filling out the form:

Delegate/Guardian

While filling out forms for children under the age of fourteen, the guardian must state his/her name, relation (on the right side), and sign the form under the section “Name the delegate”.

Stating your citizenship

This mistake generally occurs when you are holding dual nationalities/citizenship. If you fall in this category of people with dual nationalities then you should state both your citizenships on the W-7 form.

Missing signatures

Anyone above the age of fourteen is to sign his/her form themselves. An unsigned form is like an unsigned check; it is not valid. Be sure to sign your Individual Taxpayer Identification Number forms before submitting them.

Proof of identity

You do not need multiple proofs of identification while applying for Individual Taxpayer Identification Number. All you need is one authentic proof of identification like an original passport picture; it is enough of a proof.

In conclusion

We hope that this article has helped you in tackling this task with ease. However, if you require any sort of assistance with filing your W7 form or are seeking tax preparation services, then feel free to seek our assistance by contacting our experts at Accounts Confidant.