What makes a business succeed is it’s a particular lawful element isolated from its proprietors. That implies it pays its very own annual expenses. The proprietors are not liable for paying the annual charges of the company. The manner in which an organization pays annual charges is by filing Form 1120 to figure out how much they have to pay.

Also, businesses have a different income tax rate, so they don’t pay the same taxes as an individual would. The objective of this article is to inform you about what the IRS form 1120 is and how to file it.

What is the IRS form 1120?

IRS form 1120 has been designed for the specific purpose of reporting corporate income taxes. You may also use this same form to report income from separate business entities, as long as they have decided to be taxed in the same way as a corporation.

An example of this may be an LLC that elected to be taxed in the same manner as a corporation. You will use Form 1120-S if you are filing taxes for a Subchapter S Corporation.

What is the Corporate Income Tax Rate?

The Tax Cuts and Jobs Act (TCJA) overhauled the tax code. The corporate tax rate is now 21% at the top rate. There’s now a single and permanent rate for every corporate tax return filed. Take note, this only takes into account federal corporate tax bills. You still need to take into account corporate tax rates for your state.

When Do You Need to File Your Corporate Tax Return?

The IRS form 1120 is due three months after the end of your chosen corporate tax year on the 15th day of that particular month. This typically differs between corporations, but many corporations try to use December 31st at the end of their tax year.

In this case, you would have to file form 1120 by March 31st. In the event this day falls on a public holiday or a weekend, the deadline is the next business day.

Tax Deductions for Corporations

The most difficult aspect of filing your return is handling all the deductions. Nearly all business expenses are deductible in some way. But claiming each tax deduction comes with a variety of exclusions and strict limits. These change all the time, so it’s always wise to run your numbers through professional tax software to ensure you don’t make any mistakes this coming tax season.

Who needs to file form 1120?

Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an income tax return whether or not they have taxable income. Domestic corporations must file the IRS form 1120, unless they are required, or elect to file a special return.

Form 1120 instructions to fill out the form-

Note: It won’t cover every business as each business has a different set of circumstances, so make sure you speak to a professional before proceeding.

To fill out the form, you will need a range of information. The following section will contain a general outline of how you might begin gathering the necessary information to fill in this form.

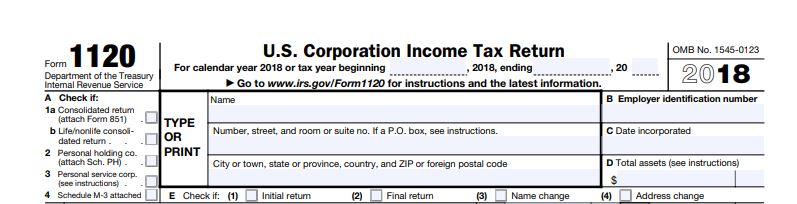

Section 1 – Supplying Basic Identifying Information for Your Corporation

The first section is easy to fill out because all you need to do is add the basic identifying information about your corporation, such as its name, its address, and its employer ID (EIN). You’ll also need to add information about the corporation’s total assets and the date your corporation was incorporated.

Section 2 – About Your Corporate Income

This section is where you begin to detail your earnings for the year. You’ll need to supply information like gross receipts, dividends, royalties, capital gains, and the cost of goods sold. Make sure you keep accurate financial records throughout the year, so this process doesn’t become a headache.

Section 3 – Tax Deductions

Any tax deductions you intend on making should be detailed in this section, such as repairs, bad debts, and taxes. You don’t need to supply documentation for tax-deductible expenses, but you should keep anything you do have on record in case you happen to get audited.

There may be additional deductions that require a separate schedule attached to your tax return, such as legal fees, travel expenses, and insurance premiums. These expenses shouldn’t be duplicated in the cost of goods sold.

Section 4 – Payments, Refundable Credits, and Tax

Section four will include your final calculations. You take your taxable income, the tax from any attached schedule, minus any credits your corporation is entitled to. If you’ve overpaid throughout the year, you’ll get a tax refund. If you’ve underpaid, you should pay the tax due.

Schedules

Sometimes additional schedules may be required. Sometimes you may have to supply them, such as the balance sheet, whereas other schedules must only be submitted if you have relevant information on your tax return.

For example, if you supply business services, you won’t need to supply a schedule for the cost of goods sold.

Let’s take a look at the most common schedules for corporations:

Schedule A – Cost of goods sold.

Schedule C – This is for any dividends or special deductions. It isn’t the same as the Schedule C utilized by sole proprietors.

Schedule J – Details for tax computation, such as credits and any special taxes you may need to pay.

Schedule K – Information about the ownership of stocks and shareholder information.

Schedule L – Your balance sheet.

Schedule M-1 – This schedule is for reconciliation of income per return and income/loss per book. Your tax preparer will typically handle this.

Schedule M-2 – You’ll provide an analysis of any un-appropriated retained earnings per your books. Again, your tax preparer will take care of this.

In conclusion

We hope that this article has provided you with the information that you were looking for regarding the IRS form 1120. However, we understand how complicated the task of filing tax forms is. So, if you seem to be facing any difficulties regarding this task, you can always seek help by getting in touch with our expert CPAs and consultants at Accounts Confidant. We ensure that your tax filing responsibilities are handled in the most professional manner.