There may come a time where you might commit a common tax filing errors. Moreover, when you do discover an error on your return, it might be a worrisome experience for you. Will the IRS audit your tax returns for the past decade? However, you need not fret. The 1040X form helps you amend such circumstances.

Moreover, if you think you’re the only person who’s made a mistake on a tax return, this is nothing to stress over. According to the IRS, you’re in good company. They estimate nearly 6 million amended returns were filed during the 2018 calendar year. Since they’re expecting more than 156 million individual returns to be filed this year. That amounts to about 4% of all returns being amended.

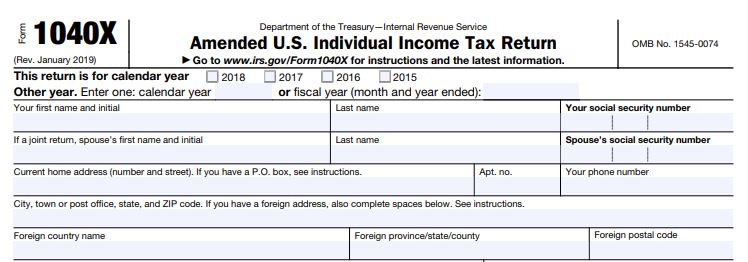

All you need to do in order to amend your returns is to fill out and file the form 1040x. The objective of this article is to explain to you what the 1040x form is and how to file it.

What is the IRS form 1040x and what purpose does it serve?

The individual taxpayer CAN NOT change anything on the W-2 form. Therefore, the employer will have to issue a W-2C corrected W-2 form if an error has been made on the W-2 form. To correct an error on the originally filed income tax return you will have to use the 1040X Amended Individual Income tax return.

File a separate 1040X form for each year you are amending. Mail each form in a separate envelope. Be sure to indicate the year of the return you are amending on the front of the form. Furthermore, the 1040X form has one column where the Correct Amount is the only figure entered. This makes it easier for you to make changes to previously filed returns.

There is an area on the front of the form to explain why you are filing the form. Generally, to claim a refund, the 1040X form must be filed within 3 years from the date of your original return or within 2 years from the date you paid the tax, whichever is later. If you file the returns before the due date (without regard to extensions), they will be considered filed on the due date.

Attach copies of any forms or schedules that are being changed as a result of the amendment including any Forms W-2 received after the original return was filed. The correctly filled out form amended individual income tax return will have to be mailed to the correct IRS address and you can find the address in the instructions for the 1040X tax form.

Note-

- Normal processing time for Forms 1040X is 8 to 12 weeks from the IRS receipt date.

- If you make changes to your federal return, your state tax liability may be affected.

For information on how to correct your state tax return, feel free to contact our expert consultants at Accounts Confidant.

How to File an Amended Tax Return

The amended tax return is just another tax form to fill out. The difference is that you can only file by mail (no e-filing), and you have three years from the original filing to submit your amended return. You can use Form 1040X to amend a previously filed:

- Form 1040

- IRS Form 1040A

- Form 1040EZ

- 1040NR (PDF)Form

- Form 1040NR-EZ

The 1040X form has three columns:

- The A Column is where you input your original figures.

- The B Column is the difference between Columns A and C.

- Column C is where you put the corrected figures.

On the back of 1040X, there is space to explain the changes and why you’re making them.

Some points you’ll want to keep in mind

- If you are filing to claim an additional refund, wait until you get the original refund (go ahead and cash the check).

- If you owe additional tax, file form and pay the tax by April 15 of the following year (or the next business day if April 15th happens to fall on a weekend or a legal holiday). The 1040X form instructions list the addresses for the service centers where your amended return needs to be sent.

- Be sure to indicate the year of the return you are amending on the front of the form.

- File a separate form for each year you are amending. Mail each form in a separate envelope.

- If your amended return includes changes to other schedules or forms (i.e. Schedule C), you must attach it to the amended return. You need to include any new W-2s as well.

- Note that your state tax liability may be affected by changes made on your federal return, so you’ll need to contact your state’s tax agency on how to amend your state return. The IRS provides links for every state website.

- Fix ALL errors, not just the ones that benefit you. There’s much folklore around what might trigger an audit, sending an amended return is one of them. So make sure it’s correct.

- You do not need to attach newly received or corrected 1099-MISC as you were not required to attach them to your original return. Employers are required to file informational copies of 1099s direct to the IRS.

Where to mail form 1040x?

If you are filing the 1040X form in response to a notice received from the IRS, then mail it and the attachments to the following address:

- Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0255

If the above situations do not apply and you live in the following states, then send the form and attachments to the following address:

For Florida, Louisiana, Mississippi, Texas, send the form to:

- Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0052

For Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Utah, Washington, Wisconsin, Wyoming, send the form to:

- Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0422

For Alabama, Connecticut, Delaware, District of Columbia, Georgia, Kentucky, Maine, Maryland, Massachusetts, Missouri, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, send the form to:

- Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0052

For individuals using an APO/FPO, who are non-residents, dual status, who live in a US possession, are permanent residents of Guam or the U.S. Virgin Islands, and other exceptions, send the form and attachments to:

- Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215 USA

In conclusion

We hope that the aforementioned information has helped you in gaining a better understanding of the 1040X form. However, if you are facing difficulties in filling the form or have any queries regarding it, then you can seek assistance by contacting our experts at Accounts Confidant +1-866-301-2307. We handle all your tax filing requirements in the most professional manner.