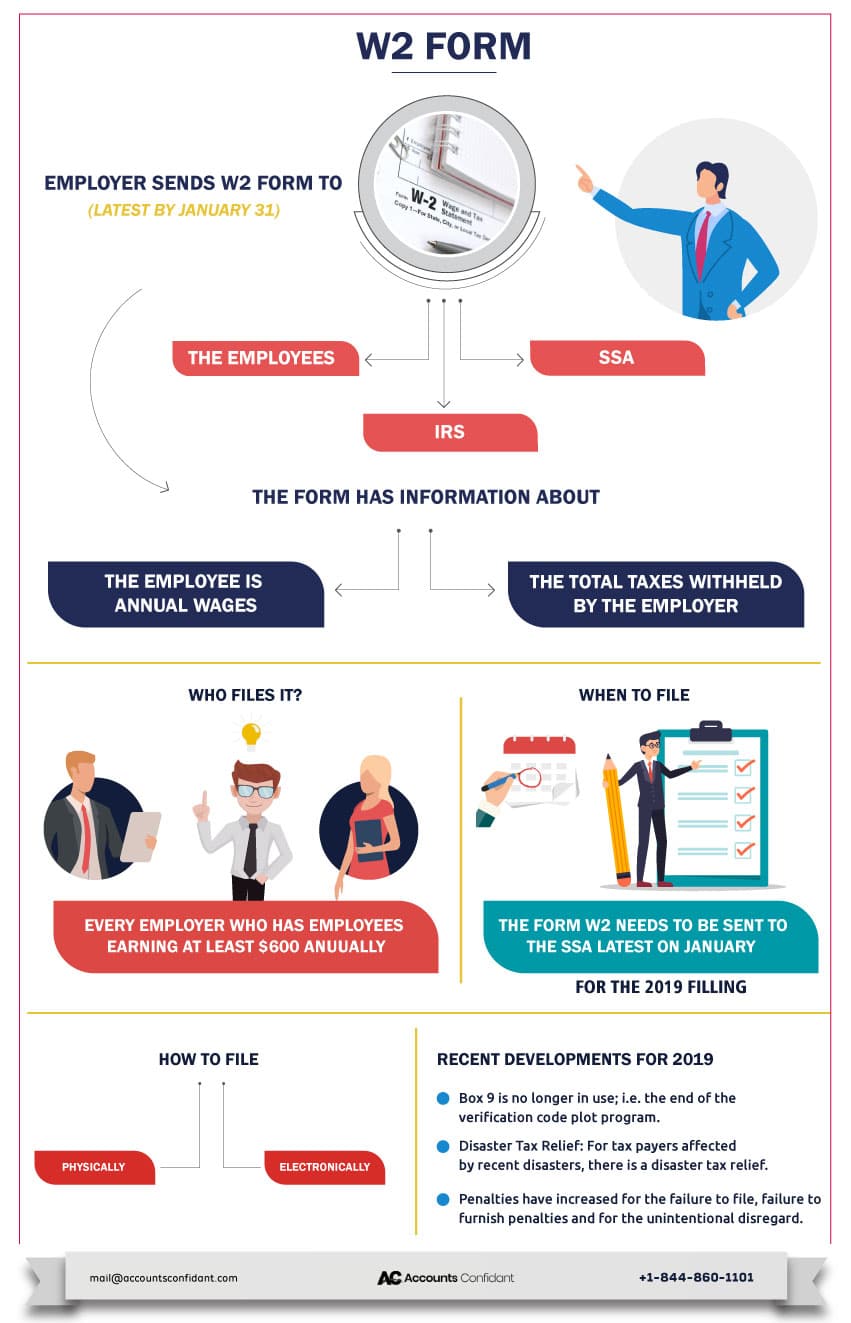

The Wage and Tax statement or the W2 Form is the form that the employer sends to all their employees and the IRS at the end of every financial year. The purpose is to report the employee’s annual wages and the amount that is withheld from their paychecks.

What is a W2 Form: The Basics

- Every employer that pays the employee at least $600 yearly, has to send them to form W-2.

- Every employer needs to send the form by the end of January.

- W2 Form differs from the W4 form; the employee files the latter to inform the employer about how much tax to withhold.

- W2 Form reflects the income earned in the year previous to the year of payment.

- Employers use W2 form additionally to report the FICA taxes.

- Employers prepare and send W-2 form for employees and consequently provide copies to the IRS and the SSA.

- These taxes are for the federal and state obligations and also include social security and Medicare withholdings.

- When the employee files taxes, the amount of tax withheld according to the W2 form is deducted from their total tax amount. In case there is a larger amount that is withheld, then it is returned in the form of a refund.

Understanding the W2 Form:

We will now understand the components of the W2 form, its parts and the complete instructions for filing it.

If you are wondering how to get W2 form, then you simply need to log onto IRS.gov and download the form. You can also order forms, parallel instructions and other publications from the same website.

Components of W2 Form:

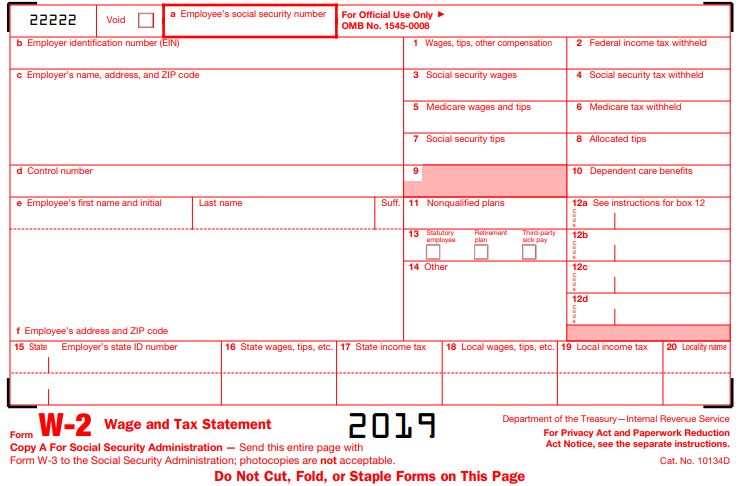

Every W2 form has the same fields. The form has the state and federal sections, as the tax obligations are on both the levels. It also contains the employer’s information, like,

- Employer Identification Number (EIN)

- Employer’s State ID Number

The employee’s total earnings from the employer are there.

The form consists of six separate copies, each with a different filing purpose:

- Copy A: This is submitted to the SSA by the employers.

- Copy B: To be sent to the employees and filled with their Federal Tax Returns.

- Copy C: This is sent to the employee and retained by them as a record.

- Copy D: The employer retains Copy D for their records.

- Copy 1: In this, they are required to be filed with the employer’s state or local income tax returns in case there are.

- Copy 2: In this, they are required to be filed with the employee’s state or local income tax returns, in case there are.

How to Fill Out a W2 Form?

Wondering how to fill out a W2 form? We have you covered. The W-2 form can look very different in relation to how your employer processed your payroll. In spite of it all, it still has the same information it requires you to fill.

There are multiple lettered boxes from A through F, it is important to understand what each of these means. All the boxes from A-F are for filling the identifying information. These include:

- Your social security number

- Employer’s tax ID number

- Everyone’s addresses

- Full legal names

Box D, on the other hand, is a control number that identifies your unique W-2 document in your employer’s records.

Let us now see the meaning of all the numbered boxes in your W-2 Form.

Meaning of Numbered Boxes in W2 Form:

Box 1: This includes the entire amount from wages that can be considered total taxable wages.

Box 2: As federal income taxes, this box includes the amount your employer has withheld.

Box 3: This includes the total wages as taxes to the Social Security Administration tax.

Box 4: As subjected to Social Security Taxes, the total amount that your employer withholds.

Box 5 and 6: The former, requires you to fill the amount out of your wages that are under Medicare tax. And in the latter, the amount that is withheld.

Box 7: Here, you need to fill the tip income reported to your employer.

Box 8: This box will include the tip income that your employer allocated to you.

Box 9: W.E.F. 2019, this line is no more in use.

Box 10: For this, the taxpayer reports the amount that comes under dependent care expenses via either a flexible spending account or the dollar value of the dependent care services.

Box 11 and 12: The former includes the amount that transfers from the employer’s non-qualified deferred compensation plan. And the latter to deferred compensation and others.

Box 13: You can excuse yourself if your classification is as a statutory employee

Box 14: If you are going to report any amount here, you also need to provide a concise on what they are for.

Box 15: This includes your employer’s state and state tax identification number.

Box 16 and 17: 16 has all the taxable wages that are earned in the state. Whereas 17 reports the total amount withheld.

Box 18 and 19 and 20: This reports the total amount of wages that are subject to state income taxes. This includes the mount eventually withheld. In 20 you provide reasons for them.

W2 Form 2019 Common Errors:

Here are some of the most common errors that you can face while filing your W2 forms. These points of precaution can help you file without any issues.

- Avoid using a light-colored ink, it is always advisable to use black ink.

- One should also avoid decimal values and cents in the entries.

- You should not add dollar signs before the amount boxes as they have been now been deemed unnecessary.

- The employee’s name needs to be in the following format:

- The first name and the middle name need to be added in the first box.

- The surname is in the second box

- And the remaining suffix such as Jr. in the third box.

- A user not temper with the state of the form and hence not cut fold Copy A and mail it to the SSA.

- It is also not advisable to mail any other copy other than the Copy A of the form W2 to the SSA.

Penalties With W2 Form:

The penalties for discrepancies in the W2 form are as follows:

- All late filings incur a penalty of $30 performs. Although, this is applicable only for 30 days after the last date of submission.

- After the 30 day window but before August 1, the penalty increases to $60 perform.

- Any delay post-August 1, leads to the taxpayer paying a penalty of $100.

- In case there are incorrect filings, the penalties are $250 per receiving the party.

- The penalty for a taxpayer intentionally not filing the tax is $500.

- Other penalties that it extends are:

- Illegible forms

- Filing by paper past the 250 limits.

Wrapping Up:

W2 Form is an essential employment tax obligation for every business. No matter the size and stage of your business, understanding the exact purpose, filing details and instructions will help you file an error free form.

Again, filing the form ensuring compliance, correctness and timeliness requires having the complete knowledge of its formalities.

If you too are rushing the deadline to file the W2 form, then we have a team of expert tax accountants who can assist you and organize the process. You can reach our team on +1-877-519-7362 and we will resolve all your woes related to W2 Form.