Tax season comes every year with lots of paperwork and mental pressure. If you haven’t got the opportunity to manage your books according to the upcoming tax season, then you should file IRS Form 4868. It is a tax extension provided to you by the IRS for the tax submission.

What is IRS Form 4868?

IRS tax form 4868 (also called Application for Automatic Extension of Time to File) is a time-extension of 6-months provided by the Internal Revenue Service (IRS) to submit your tax returns. The date of filing the tax return from April 15, 2020, will be extended to Oct. 15, 2020.

The assessee won’t be asked any questions from the government about the delay – just fill the form and submit them. The assessee will be contacted if the extension under the IRS 4868 form is denied (or) only if the IRS 4868 form is rejected!

There is a set of guidelines set by the tax authorities to be followed if you wish to file IRS Gov form 4868:

- You should have filed your taxes for the previous year.

- Aggregate your total liability and fill it on the form.

- The form should be submitted by April 15.

What is the Purpose of IRS Form 4868?

IRS Form 4868 grants 6-months extension from the tax authorities in the US to the tax-payers. The assessee might want this time-frame to collect all of the necessary information to prepare the return. The purpose served by this form is that you will have the extension, and with that, you can avoid any late-filing penalties. But this does not suggest, that you will not be liable to pay your return in the month of April. You will be charged with interest for a 6-months extension period & face potential penalties if the extension date has surpassed.

Who files IRS tax form 4868?

IRS allows taxpayers to use the IRS tax form 4868 when they want more time to collect the required documents. Below are the forms to which IRS grants the potential extension:

- Form 1040: U.S. Individual Tax Return

- Form 1040-SR: U.S. Tax Return for Seniors

- Form 1040NR: U.S. Nonresident Alien Income Tax Return

- Form 1040-NR-EZ: U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents

- Form 1040-PR: Self-Employment Tax Return-Puerto Rico

- Form 1040-SS: U.S. Self-Employment Tax Return

Instructions to File IRS Gov Form 4868

It is quite unchallenging to fill this form – it does not require any date or signature and is only half a page. Furthermore, the superlative attribute of this form is that you don’t have to mention the reason for requesting an extension.

You have to provide below information on the form:

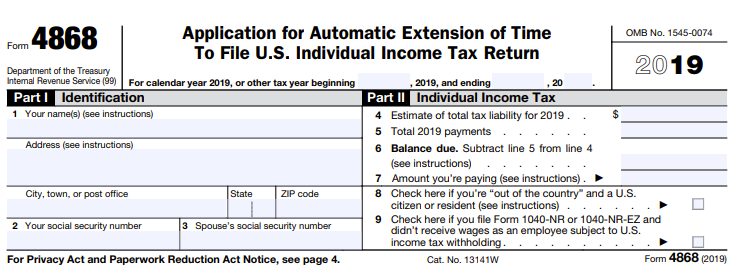

Part A – Self-Information (Part I – Identification):

Your name, address, SSN and if applicable, your spouse’s SSN.

Line 1: Name

Firstly, you have to provide your name and address. If you are filling the form jointly with your spouse, then both spouses’ names should be provided in the tax return documentation. Events like marriage, divorce or any other reason can change your name. In that case, you have to notify the Social Security Administration of your name change before filling out the form.

The same case is applicable to the address. If you want IRS tax extension notices mailed on another address, then that also is filled out in Part I of the form. Tax Form 8822 (Change of Address) is applicable when there is a change in your address in the prior and current tax filing.

If your name or address is not registered properly in the SSA records, then your tax extension application will be denied by the IRS.

Lines 2 and 3: Social Security Number(s)

You have to fill out the SSN on line 2. If you are filing jointly with your spouse, then in Line 3, you have to mention your spouse’s SSN.

Those who do not possess SSN or are ineligible for one, then they should write their Individual Taxpayer Identification Number (ITIN) on the form. Generally, ITIN is used to file your tax return, so you should raise the ITIN request to IRS as soon as possible.

Part B – Income Information (Part II – Individual Tax Income):

You have to mention the “good faith estimate” of your final taxes on the form. Subtract from this your aggregate payments of tax for the year from retaining and any evaluated charges. Your evaluated liability for the year is more noteworthy than your complete expense installments, you have money owed. Round-off your cents to the nearest whole dollar to make the calculations easy.

Line 4: Estimate Your Overall Tax Liability

Furnish your total income tax liability for the year – be sure that the numbers you are providing on the form as precise as possible. For example, if your overall liabilities accumulate to nil, then you can enter 0 on the application. Incorrect numbers on the form can lead to IRS penalties and interest.

Line 5: Provide Your Total Payments

All of your income tax returns are filled on this line which will include your tax payments and money which owe as a tax to the government. Be detailed in this line – as you have to provide your earned income to the government. Failing in the numbers will ring a bell to the IRS.

Line 6: Balance Due

You can calculate your aggregate tax payment by subtracting the amount aforementioned in Line 5 from Line 4. If the amount of Line 5 is greater than Line 4, then you don’t have to pay any taxes to the government. Basically, you will get an aggregate unpaid tax amount.

Line 7: Amount You’re Paying with Your Tax Extension

The final amount of the tax return to be paid to the IRS is mentioned here. If you are not ready with the amount mentioned on Line 6, then you can file for the extension. Try to pay the tax as much as you can because it will result in reduced accrued interest and penalties on your outstanding balance.

Line 8: “Out of the Country” Filers

This option is applicable to the individuals residing out of the boundaries of the US & Puerto Rico.

Line 9: Form 1040NR and 1040NR-EZ Filers

You can tick this box if you fulfill both the conditions: your tax return date is in mid-June and you did not receive wages from Federal income tax.

What are the Penalties under IRS Form 4868?

Interest

IRS won’t let you go by just filing the form and stating your reason of unable to pay it. Instead, you have to pay the interest to the tax authorities on your unpaid tax. The interest amount will be accrued until you don’t pay the final tax amount.

Late Filing Penalty

If you are unable to pay your tax return even after the extension, then you are liable to pay 5% of the amount due for each month as a penalty. The IRS can impose penalties up to 25%, and not more than that. If you delayed your tax return for more than 2 months, then the minimum penalty of $330 will be imposed or the balance of the tax due on your return, whichever is smaller.

What are the Common Mistakes While Filing IRS 4868 form?

Below mentioned are some common mistakes while filing the form:

Name Misspelling: You have to cautiously fill your & your spouse name on the form. Any misspelling can result in the denial of the tax extension to you because your name details won’t match with the IRS records.

Wrong Address: Providing the wrong mailing address on the form can cost you denial from the IRS. In case, your form has an extension approval, but due to the wrong address, the approval won’t reach you. You have to make sure that your mailing address is correct.

A discrepancy in Social Security Number (SSN): While filing the SSN on your form, you have to keep a close watch on the numbers. One wrongly filled digit on the form will negatively affect your application.

Inaccurate Tax Number: Always fill the precise tax amount on the form. IRS will surely check your entire form under strict supervision. The amount on the form should be equivalent to the amount in your books.

Wrapping Up

Tax payment to the government on time is a rightful act, but there can be a time when the business is not ready to pay returns. The IRS helps you by granting you the 6-months extension period in filing your tax. All you have to fill out the IRS Form 4868 – and avail the extension. We, at Accounts Confidant, provide the best tax services to file; we will assist you from the nascent stage of filling the IRS 4868 form till its filing. Contact our Tax Consultants on our Customer Service Number +1-877-519-7362.