It’s that time of the year again. You will have to start thinking about your organization’s tax return filing. Furthermore, this means that you will have to fill out the IRS form 990. Now, you may not be aware of this taxation requirement, or what to even put down in this form.

However, you need not fret as we will go through all the details of the IRS form 990. Feel free to contact our personnel at Accounts Confidant if you want to accelerate the process. Our professional team will surely resolve all of your queries.

What is the IRS form 990?

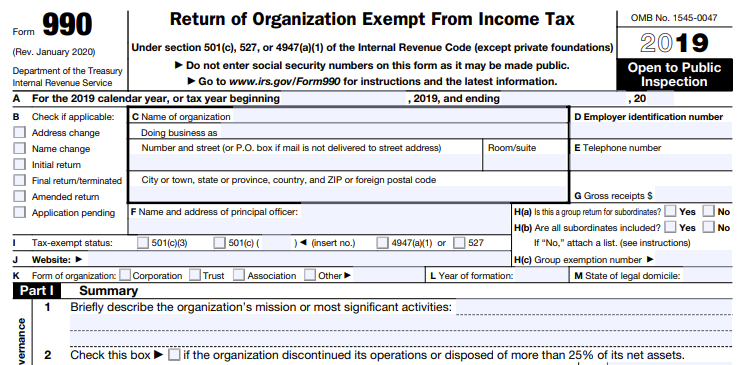

Form 990 is officially known as the “Return of Organization Exempt from Income Tax” in the United States tax nomenclature. The objective of this form is to provide all the financial information about a non-profit organization to the government agencies. This will prevent organizations from abusing their tax-exempt status. Some of the nonprofits organizations (hospitals and other health care organizations) have to abide by the comprehensive reporting requirements.

The purpose of the IRS form 990 is to provide the public and the government with a picture of the organization’s activities on a yearly basis. The amount of information that an organization is required to provide varies from minimal to extensive. The instructions provided in the form can amount to 100 pages. If the organization does not file on time then it can be subject to a stiff penalty.

- IRS Form 990-EZ – You can fill out this form if you operate in the tax-exempt organizations and nonexempt charitable trusts. Your receipt should be more than or equal to $200,000/total assets are more than or equal to $500,000.

- IRS form 990-N – You can fill out this form electronically if you operate in nonprofits organizations. The receipt should be under $50,000. If the revenue is less than or average to $50,000 from the last 3 consecutive years, then the organization must file IRS form 990-N.

How to find IRS form 990 filings

When seeking grants and from these foundations, non-profits are wise to first check the 990s, as this information will give vital clues about what types of programs they support and how much money can be reasonably requested.

Websites like “The Foundation Center” has a complete list of both foundations and their recent 990 forms, all searchable online. All you need to do in order to find them is visit the Foundation Center’s 990 Finder. Enter the name of the foundation you’re researching and click “Find.”

If you are facing issues with finding form 990 filings, you can always enlist our help at Accounts Confidant. We’ll make sure to find the filings that are adjacent to your business dealings.

IRS form 990 instructions

The following are instructions that will help you fill out the IRS 990 form properly:

- Firstly, mention the name of the corporation and its address at the beginning of the form.

- Note down the Employer Identification Number

- Select the type of tax return that the corporation files.

- Enter the date and place of incorporation on lines 1 and 2 respectively.

- Select partial or complete liquidation in line 3.

- You have to write the date for when the plan of partial or complete liquidation was adopted on line 4.

- Mention the IRS Service Center where the preceding tax return was filed on line 5.

- Note down the last month, day and year of the preceding tax year and the final tax year on lines 6 and 7a respectively.

- Check “Yes” or “No” in line 7b to answer whether the corporation’s final tax return was filed.

- If you check “Yes,” enter the name of the common parent under which the consolidated return was filed and its employer identification number.

- Enter the aggregate number of shares that were outstanding when the dissolution of the business was approved on line 8.

- Mention any dates on which amendments to the dissolution plan were adopted on line 9.

- Fill out the section of the Internal Revenue Code under which the corporation is to be dissolved on line 10.

- Provide the date of any IRS form 990 that was filed previously on line 11.

- Attach the resolution or plan in which the dissolution of the business or was approved and all amendments not previously filed.

- Finally, sign and date the form.

Which rendition of the 990 form should I use for my organization?

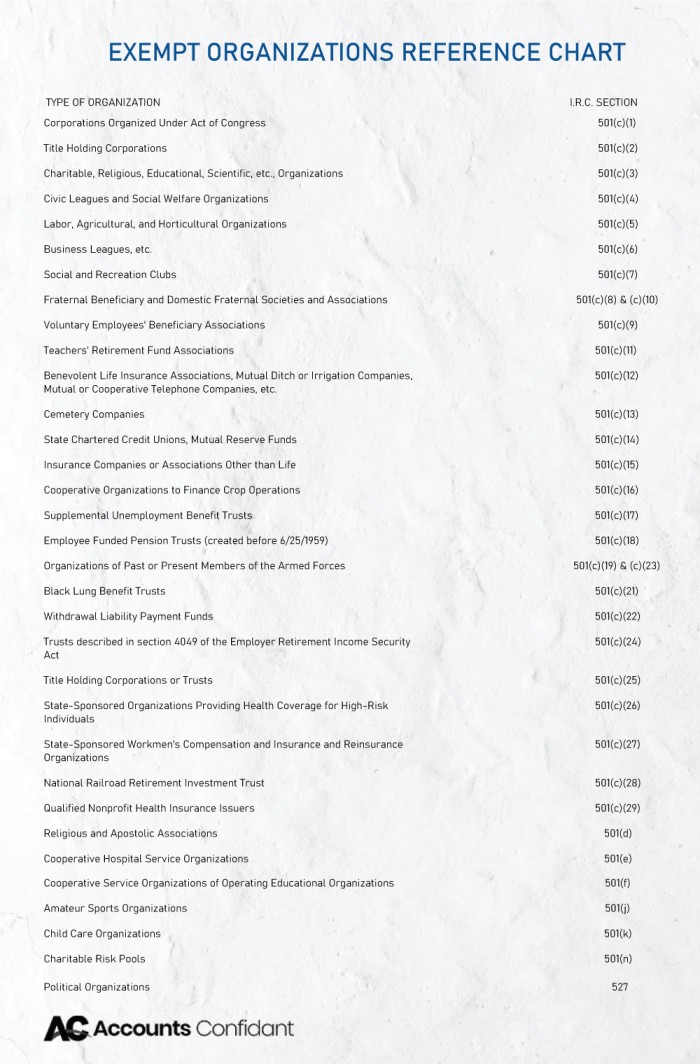

There are numerous renditions of IRS form 990 like the IRS form 990-N, IRS form 990-EZ and the 990 long form. Filing the IRS form 990-N, IRS form 990-EZ and the long form completely depends upon the organization’s gross revenue. Take for instance:

- If your organization’s annual gross receipts are more than or equal to $200,000/total assets are more than or equal to $500,000, you need to file 990 long form.

- If your organization’s annual gross receipts are less than $200,000/total assets are less than $500,000, you can choose the IRS form 990-EZ.

- When your organization’s annual gross receipts is less than or equal to $50,000, then you can file the IRS form 990-N (e-postcard).

- You can also decide to file Form 990 (long form) for your organization as it can accommodate all of the annual gross receipts/total assets options listed.

However, if you are having trouble deciding which form to file, you need not fret. Our sales team and consultants at Accounts Confidant can help you in selecting and filing the Form 990 that is appropriate for your organization’s filing.

What will happen if I unable to file the Form 990?

The IRS will disavow the organizations expense excluded status if they neglect to file the 990 form for three successive financial years. The repercussions of losing that status are noteworthy.

The association would then need to re-apply for 501(c) status, which requires a structure significantly more perplexing than the standard Form 1023 application. In the event that you haven’t just arranged the Form 990 for your organizations a monetary year, right now is an ideal opportunity to do as such.

It is common for an organization to record on a schedule. In fact, organizations whose monetary year finished on December 31st must record a finished return. Or they can go for a six-month augmentation by May 15th.

Common errors to avoid whilst filing form 990

The following are some of the most commonly occurring errors that one can commit whilst filing the IRS form 990:

- Failing to complete Schedule A. You can fill this section of the form when you are a charitable trust. In this section, highly-paid independent contractors and top officials’ benefits and salaries are present.

- Failing to note primary exempt mission as required in the statement of program accomplishments.

- Arithmetic errors account for about 20% of all 990 tax returns like not having the signature of any of the organization’s officers or failing to attach required supporting schedules.

In conclusion

We hope that this article has provided you with the information that you were looking for regarding this topic. If you are facing any sort of issues when it comes to filing IRS form 990, you can always get in touch with our experts at Accounts Confidant.