Are you a trustee, assignee, executor or another person answerable on the behalf of decedent’s estate? You must have to file IRS Form 56. In case, there are various trustees for one estate, then all of them require to file Form 56 individually. During filing Form 56, it’s required that the trustee ensures whether the decedent had a list at the time of death or a valid will.

During filing Form 56, it’s required that the trustee ensures whether the decedent had a list at the time of death or a valid will.

A receiver, assignee, and bankruptcy trustee can also file Form 56. If the judiciary is acting on a behalf of a trustee, then you require to enter the date that the court assigned the assets. It indicates that the trustee has experience to manage the debtor’s assets. A trustee can file on behalf of bankrupt company or person, but each one has to file a separate form.

Before knowing about Form 56, we have highlighted several important terms that you should know:

- Fiduciary: A fiduciary is a person who holds an ethical or legal relationship of trust with a person or group of persons. Normally, a fiduciary assumes the duties, rights and powers of the person for whom he/she is acting.

- Fiduciary relationship: This is a relationship in which one party holds confidence and trust and influenced by another to whom the fiduciary duty has assigned for the profit of the party. This relationship is also called confidential relationship and exists between attorney and clients, trustee and beneficiaries, agents and principals, receivers and trustee, etc.

- Trustee: A trustee is a firm or a person who holds assets or property for the profit of third party. A trustee has been assigned for various purposes such as, for a trust fund, in the case of bankruptcy, pensions or retirement plans.

- Decedent’s estate: A decedent’s estate is a personal property that a person owns after death.

What is IRS Form 56?

Form 56 is utilized by the fiduciary (An executor or a Trustee) to inform the IRS regarding the creation or termination of a fiduciary relationship under section 6903. The fiduciary must file Form 56 whenever the fiduciary relationship changes and provide notice of qualification under section 6036. IRS Form 56 informs agencies and creditors about sending mail concerning the fiduciary’s estate.

The main purpose of Form 56 IRS is to establish the fiduciary or a trustee who will be responsible for the estate accounts. The following are the conditions whenever you require to file the form IRS 56:

- Appointment of an executor for an estate.

- Appointment of a trustee for a trust.

Instructions for IRS Form 56

You may need to have a copy of the form from the IRS and directly filed with the IRS. The fiduciary has the responsibility of filing the form after the establishment of fiduciary duties.

First of all, you have to provide information on the decedent. Fill in the decedent ITIN or SSN on final Form 1040 if you are acting in support of decedent. And if, you are acting on the behalf of decedent’s estate, you have to enter the information of his/her Form 706.

As the fiduciary, you must file Form 56 IRS and describe your role as fiduciary in the Form 56. Below are the roles that a fiduciary can assume:

- Personal Representative

- Executor

- Conservative

- Assignee

- Guardian

- Trustee

- Receiver

When to file IRS form 56?

As a general rule, it must require to fill out IRS form 56 while creating or terminating a fiduciary relationship. Additionally, you need to file Form 56 IRS during filing the first fiduciary tax return.

Form 56 IRS will take an average of 46 minutes to be filed and 32 minutes to read applicable law and the instructions. You should keep in mind the following points while filing IRS Form 56:

- In case, you want to update business, entity, or last known address of the person, then you don’t need to file Form 56. The Fiduciary can use Form 8822 to change the address of the person.

- You must have to provide evidence that validates your authority to act as a fiduciary.

- The Fiduciary can’t utilize Form 56 to inform IRS that he/she is the authorized representative of the taxpayer.

- You can’t use Form 56 to demand copies of notices and correspondence.

How to fill out Form 56?

In order to fill the form properly, you need to follow the steps below:

- First of all, you need to download the form from the official website of Internal Revenue Service with the instructions of filing. You can easily find both of them on the website. After that, open the PDF element.

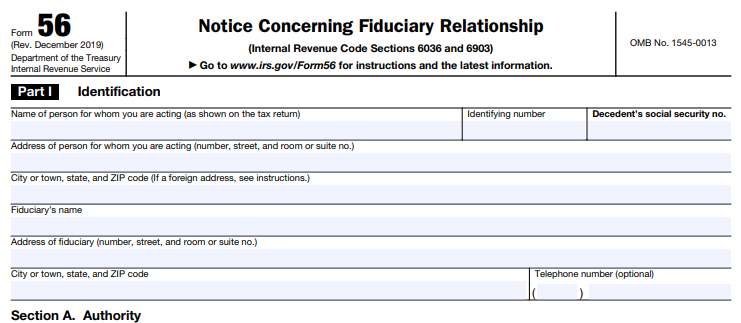

- Now, you are required to fill out the Part 1 (Identification).

- In this part, you need to write the name of the person for whom you are acting in the first line. The name must be similar to the tax return.

- Then, add the identification number and the Decedent’s social security number. This will be followed by the address of the person for whom you are acting for. You must include the street, room or suite number, state, the city or town, and the zip code in the address. In contrast, you need to follow the instructions if the address in question is a foreign address.

- After that, you have to write the fiduciary name on the space given followed by the fiduciary address in which you must include the street, room or suite number, city or town, zip code, and the state. You will also get the option of adding telephone number (Optional).

- Now, you need to go to Section A (Authority for the fiduciary relationship). Verify the applicable boxes from 1a to 1f. For instance:

- Mark the box 1a if the fiduciary relationship is based on the court appointment on the testate estate.

- Mark the box 1b if it is based on court appointment for in testate estate. Persist to check the suitable boxes as you read through 1a to 1f.

- Though, if you mark the box f (Other), you have to write down the description of it.

- Go to the option 2a and check if 1a and 1b have been marked, then you need to enter the date of death. Along with this, write down the date of appointment, taking office or assignment if you mark the boxes 1c to 1f.

- You need to fill out the Section B (Nature of Liability and tax Notices).

- Firstly, you need to mark all that applies for types of taxes on No 3. The options will be generation skipping transfer, income, employment, excise gift, Estate, and other. Make sure that if you mark the “Other” box, then you need to write the description of the type of tax.

- After that, mark all the checkboxes for federal tax form number on No 4. You will have form numbers from a to h, mark the correct box. If you have marked the checkbox h, then give the details. You need to complete the table is you want to mark the line 6. You need to add the year or periods to mark 4a and 4h.

- Complete the Part II Revocation or Termination of Notice.

- If you need to terminate all previous notices regarding fiduciary relationship with IRS, then mark the boxes 7a to 7c.

- You are required to mark 7a if it is court order cancelling fiduciary authority.

- In case, there is a termination of a business entity or dissolution certificate, mark 7b. If the revocation is due to other things apart from one listed on 7a and 7b, then you have to mark 7c. However, you need to write the description.

- You require to view instructions and complete them appropriately for No 8 and 9.

- Now, you need to fill out the Part III- Court and Administrative Proceedings.

You must provide the name of court, the address of court, the docket number of proceedings with the date. Along with this, you need to provide the date proceeding is started, and time of other proceedings.

- Go to the last part of IRS Form 56 Part IV (Signature).

In this part, you need to sign Form 56 to complete it.

Where to send IRS form 56?

The fiduciary can directly mail IRS form 56 to the IRS departments in your state where the person for whom the judiciary acting is mandatory to file tax returns. You can take the help of a tax professional to find the address of your state’s office or visit the IRS Website. Before mailing form 56, make sure that you have attached all the mandatory documents.

Due to the amount of documentation signed with Form 56, you probably won’t able to take advantage of the paperwork reduction.

In Conclusion

Expectantly, the aforementioned article has provided you all the aspects about what IRS Form 56 is. If in any case, you are experiencing issues while acquiring the form or filing it, you are suggested to get in touch with our experts at Accounts Confidant. We will assist you in filling out the Form and mailing it to the correct address.