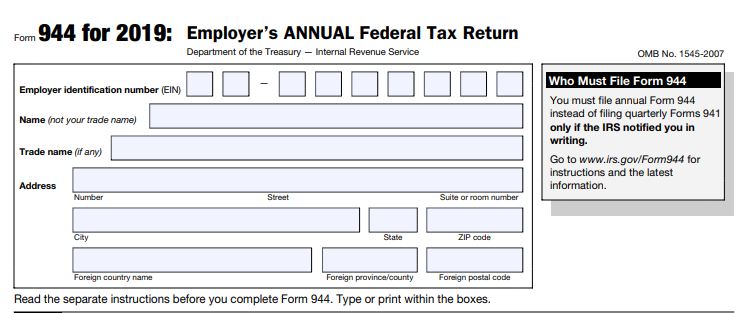

What do we mean by Form 944?

IRS Form 944 is outlined so the smallest businesses (those whose yearly risk for government disability, Medicare, and retained federal income tax range is $1,000 or less) will document and make good on these regulatory expenses just once per year rather than each quarter. In case you’re an entrepreneur and you pay under $1,000 in finance charges or payroll taxes (government personal expense or federal income tax, standardized savings or social security, and Medicare retained from representatives) at that point you may fit the bill to settle your bureaucratic regulatory obligation returns every year rather than quarterly.

What is the Purpose of Form 944?

Form 944 was planned to offer private venture employers a reprieve when it came to documenting and making good on government finance regulatory expenses. The other purpose of Form 944 is to spare the IRS worker hours and assets by streamlining the procedure for all parties included.

How would you know whether you are needed to record IRS Form 944?

The IRS will caution you if in case your business ought to document Form 944. They more often than not send a notice if the sum owed in business charges through the span of the earlier year was under $1,000.

Where do we Mail IRS Form 944?

- Form 944 in general needs to be always mailed to your states IRS office.

- In fact, you can also very well try to locate your state’s local IRS office by login onto IRS.gov or simply get in touch with a tax expert or a professional who can better walk you through the whole procedure of filing Form 944.

- Another option for you to file this Form 944 can be online or the other alternative option that you can choose is to use a third party to e-file.

What is the IRS form 944 usability?

Employer’s ANNUAL Federal Tax Return or Structure 944 is in most general cases selected to keep a report of government personal assessment or in other words federal income tax and FICA charge (Social Security and Medicare charges) on worker compensation.

Many CEOs and business stakeholders are supposed to record Form 941, Employer’s QUARTERLY Federal Tax Return.

If your business qualifies, the IRS will tell you that you should document Form 944. Recording Form 944 methods you are in charge of revealing assessments once every year rather than four times each year.

What is the variation between IRS form 941 and 944?

- Contingent upon the sort of business that you claim, you are required to round out either IRS Form 941 or Form 944 so as to maintain a strategic distance from IRS penalties.

- These two structures are the contrast between whether you document your charges and guarantee charge conclusions quarterly or every year.

- As a rule, most by far of organizations will record Form 941. This structure is intended for organizations that make good on their regulatory expenses and record for duty conclusions quarterly.

- Most by far of organizations are required to settle their government expenses and record charge reasonings quarterly, and this is prudent because of the way that it makes accounting a lot simpler in general.

- Form 944 is intended for organizations that rather record assessments and deduct imposes yearly.

Conclusion:

In this article, you all must have got considerably a good clarity with regards to “Form 944”. As we have bifurcated this topic into different sections in order to get a deep insight about the Form 944. We Accounts Confidant do realize the fact that it is highly elemental to have a good knowledge and should be able to file Form 944 for every business. In case you have any doubts with regards to CPA Near Me, please feel free to call us back on our Toll-Free +1-877-519-7362 today to learn more about Form 944 and discuss it with one of our team of expert CFO’s.