Usually, on the first day of a new job, taxpayers are asked to complete a W-4 form. Now, I’m sure that during such proceedings you must have wondered “what is a W-4 form?” Well, you need not fret. A lot of people don’t really have a clear idea of what the W4 form is or its purpose.

In a nutshell, W-4 is an IRS form that you must fill out in order to inform your employer about the amount of money to withhold from your paycheck for federal taxes. However, if you would like to delve much deeper into details of this form and its purposes, then keep reading this article. To begin with, let’s try and understand what the form W-4 is.

What is a W-4 form?

This form completely revolves around the idea of “allowances.” If you claim more amount of allowances, your employer won’t be able to withhold a lot of money for taxes.

This form is a simple two-page report with a worksheet on both the first and second pages. The first page lists a worksheet to add up the total number of allowance followed by the employee’s personal information like name, address, social security number, and marital status.

The second page has a worksheet that is required if the employee can itemize on his or her tax return. Itemized deductions include mortgage interest, property taxes, medical expenses, charitable contributions, and unreimbursed business expenses.

The IRS provides you with the three following worksheets to help you determine what to claim on a W-4 and the total number of allowances you should claim:

- Personal Allowances Worksheet

- Deductions, Adjustments and Additional Income Worksheet

- Two Earners/Multiple Jobs Worksheet

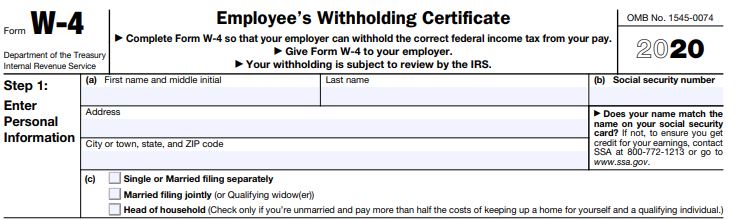

Above all, keep in mind, the IRS has made some changes to the 2020 version of the form. Take a look.

Changes made to the 2020 version of the IRS form W-4

The W-4 form 2020, is substantially different from the previous W-4 form 2019 and W-4 form 2018 versions. The following are the changes made to the form:

- The form has been modified to comply with the income tax withholding requirements in the Tax Cuts and Jobs Act (Pub. L. 115-97).

- Also, the concept of withholding allowances to account for tax credits, deductions, and additional income has been completely omitted from the form. However, it does consist of sections where you can mention those amounts. These amounts can be used to calculate the withholding amount later on.

- The IRS also created a new publication. It’s called Publication 15-T, Federal Income Tax Withholding Methods. This section provides you with a clear overview of the process of withholding, how it is calculated in regards to the prior year and 2020 forms.

You can download a copy of the W-4 form 2020 from our website. If you are facing any difficulties with completing or filing the form, you can enlist the help of our experts at Accounts Confidant.

How to fill out a w4 form?

You will need to execute the following steps verbatim in order to fill out your IRS W-4 form correctly:

- Firstly, you will need to enter basic personal information like your name, marital status and address.

- The W4 form 2020 version has gotten rid of the section that require you to select an amount of allowances. Instead, all you need to do is provide certain income estimates.

- Next, if you’re single or married and work multiple jobs both, you should file jointly. In such cases, there’s usually a W-4 on file for each job.

- If you don’t want your employer to find out that you work multiple jobs, or that you earn an income from other sources, then, tell your employer to withhold an extra amount of tax from your paycheck on line 4(c). Don’t mention the surplus income into your form. Instead, send the estimated quarterly tax payments to the IRS yourself instead.

- Moreover, if you want to claim that you’re exempt from withholding on the W-4 form 2020, mention the word “exempt” in the section located below step 4(c).

- You will need to complete steps 1 and 5 in a routine manner.

- Finally, if you plan to keep claiming exemption from withholding, then you’ll need to fill out and file a new form every year.

Tips for filling out a W-4 form

You can use the following tips to fill out your form more smartly:

See if you’re exempt from withholding

Your employer won’t withhold federal income tax from your pay you’re being exempt. Usually, there are only two ways through which you can be exempt from withholding:

- If you had no tax liability last year and you received a refund of all your federal income tax withheld.

- You expect the aforementioned situation to take place this year.

Get comfortable fiddling with your withholdings

Fiddling with your withholdings is alright. You can provide your employer with a new W-4 form any time. This implies you can finish the structure, offer it to your manager and afterward check your next check to perceive how a lot of cash was retained. At that point you can begin assessing the amount you’ll have removed from your checks for the entire year.

On the off chance that it doesn’t appear as though it’ll be sufficient to cover your entire assessment bill, or on the off chance that it appears as though it’ll wind up being an abundant excess, you can present another frame and change. On the off chance that you need an additional sum retained from every check to cover charges on independent pay or other salary, you can enter it on lines 4(a) and 4(c) of the form.

File a new W-4 form whenever a significant change has occurred in your life

You can make changes to your form at any time. But, if any of the following situations occur in your life over the course of the year then you should update your W-4:

- You only work for a specific portion of the year.

- You take a pay cut or attain an appraisal.

- If you have a lot of dividend income.

- If you get married or get an annulment.

- A freelance gig on the side.

- In case you purchase an estate.

- In case you have a child.

Doing so will help your withholdings reflect your tax life.

In conclusion

We hope that this article has helped you in gaining a better understanding of what the IRS W-4 form is and how to fill it out. Now, we understand how complicated it can be to attain and complete this form. Hence, not only do we provide you with form on this website but we also help you in completing the form. All you need to do is dial our Customer Service Number +1-877-519-7362 and seek help from our Accounts Confidant experts regarding this or any other tax preparation services.