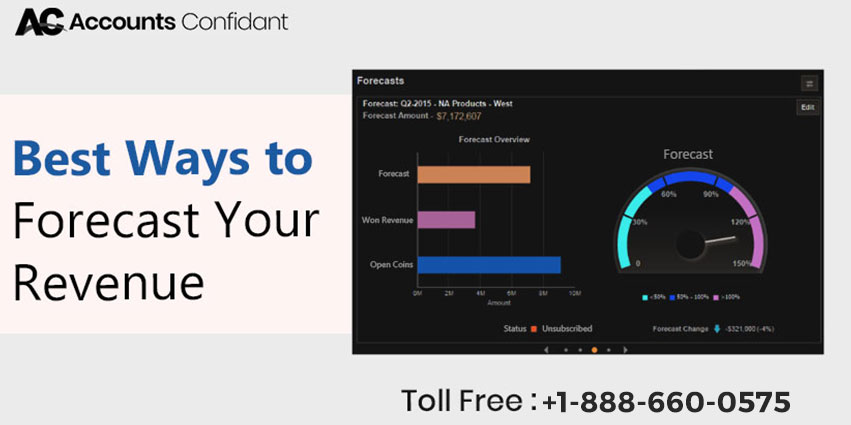

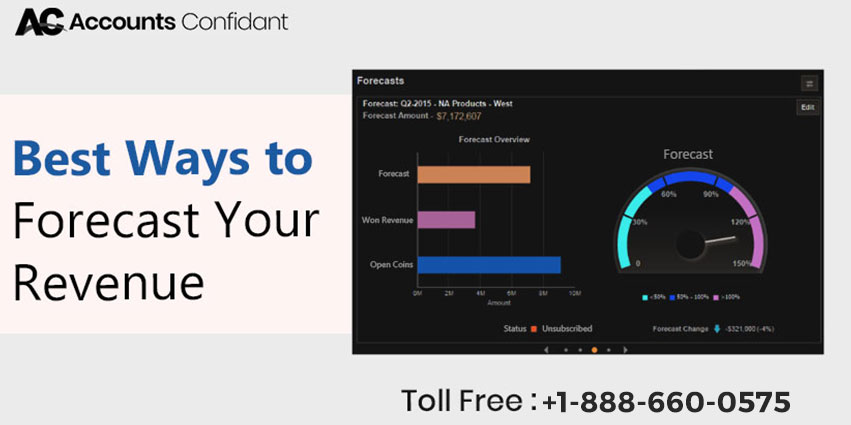

A business surely runs better with forecasting. That business runs smoothly which has forecasting in its planning foundation. With this said, let’s dive into our topic: How to Forecast Revenue!…

Learn More

A business surely runs better with forecasting. That business runs smoothly which has forecasting in its planning foundation. With this said, let’s dive into our topic: How to Forecast Revenue!…

Learn More

What is Bookkeeping? Bookkeeping is the standardized recording and regulating of financial transactions in a firm. Overall, it’s always integral to always maintain strong and reliable accounting and bookkeeping services…

Learn More

What do we mean by Form 944? IRS Form 944 is outlined so the smallest businesses (those whose yearly risk for government disability, Medicare, and retained federal income tax range…

Learn More

What is Income Tax? An income tax is a tax levied by the government, that is extended on businesses and individual incomes, spanning within a particular jurisdiction. Income tax is…

Learn More

What do we Understand by Form 941? IRS Form 941 is utilized by employers to report their federal withholdings. This form is also known as the Employer’s Quarterly Tax form.…

Learn More

The moment you employ your first employee, you are responsible for filing payroll taxes. And yes, this also includes whether you, yourself are your only employee! It is also true…

Learn More

Accounts Receivable tracks the revenue owed from the customers at any given point in the financial year. As the business records an increase in sales, so does the balance of…

Learn More

The Wage and Tax statement or the W2 Form is the form that the employer sends to all their employees and the IRS at the end of every financial year.…

Learn More

Looking for help? Talk To Our Bookkeeping And Taxation Experts and Get Your Issue Solved!

Toll-Free: 1-844-860-1101