There are instances where you need tax transcripts of your previously filed tax returns and tax information from the IRS. You need to file IRS Form 4506-t to get access to the printouts of your previously filed tax cycles.

You need to file IRS 4506-t Form when:

- They need to complete tax returns of a current year.

- Form 4506-t is also used to request for copies to amend any issues and discrepancies with a previous year’s tax returns.

- In case there are requirements for claims, refunds, abatements and benefits from the government, then having the tax transcripts with the help of form 4506-t IRS are required.

- Also in case of verification of income or to apply for loans, these transcripts can come in handy.

- You can also send it to third parties, like mortgage lenders, etc.

What is IRS Form 4506-t?

4506-T IRS Form is used to request for copies of the tax returns that have been filed previously. These reflect the dates, filing status, dependent information and added status of the income as well as tax liability of various tax cycles. There can be multiple forms that you can request a transcription for, some of which are:

- Form 1040: You can use this form to file for the annual income tax returns.

- IRS Form 1020 Series: This is the series that are used by S Corporations to file tax returns.

- Form 1041: You can use the form 1041 to file any tax liabilities of an estate or trust. This can include incomes, gains, losses, etc.

There are different types of the IRS tax form 4506-T, through which the transcripts can be attained for the above-mentioned forms. These are:

- Form 4506-T: This assists taxpayers to request for transcripts of previous tax returns. You need to check related but different parts of this below mentioned form. Add to that, the tax information that can be furnished using the form 4506-T can be used only for the current and previous three tax years for the following forms which are: Form 1099, Form 1040, Form 1120, and Form 1065.

- Form 4506-T-EZ: This is the short for request for the individual tax return transcript. In this, you get printouts of the returns rather than the complete package of the full copies with all the attachments.

Who Can File Form 4506-T?

The form can be filed by taxpayers, who have previously filed their returns. Additionally, the forms can also be sent to third parties upon further request. In that case, you are required to sign and file the form 4506, and the IRS will send it to the designated party on your behalf.

IRS Form 4506-T Instructions:

To begin the process of filing the form, and before we tell you how to file Form 4506-T. It is important for you to get the form.

There are various ways to receive transcripts apart from filing the form, you can seek them to begin with before you start the filing process. Some of these are:

- Telephone: You can easily get the transcripts by calling the IRS helpline number (800)-908-9946 and request for transcripts. These will then arrive via mail, within a window of 10 days.

- Website: You can log onto the IRS website and choose the “Get Transcript by Mail” option, in this case too, it will arrive within a window of 10 days.

- IRS Get Transcript: Set up an account with the IRS online and download your scripts is another method. Although, there is a very strict authentication process to this, which is why most of the people are unable to access the same.

- Get in touch with a professional tax advisor: You can get in touch with us and our team will contact and follow up with the IRS to help you get access to your transcripts faster. You can call us on +1-888-660-0575 for the solutions!

If you are vouching to use the IRS form 4506-T and are wondering how to fill out IRS form 4506-T, then just follow the instructions below.

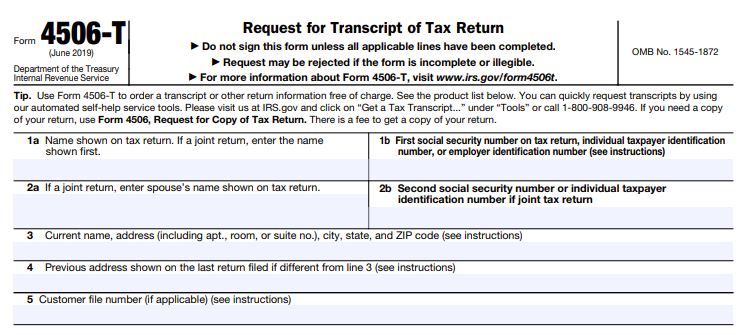

Step 1: Line 1: On line 1a, you need to enter the correct name as filed on the tax return. (In case there is a scenario of a joint tax return. You need to write the first name on the joint tax return.)

Line 1b: Here you need to enter your Social Security Number. In case it is a business, you need to enter the employer identification number.

Step 2: Line 2: On line 2a. you are required to write your spouse’s name, in case you file a joint tax return.

2b: Here, you need to add the social security number of your spouse.

Step 3: Now you are on line 3 and you need to write your address, as mentioned on the tax return. Please make sure that all the information that you furnish, matches with the one that is given on your tax return.

Step 4: Line 4 is given so that you can bring it to the attention of the IRS, that the address you mentioned in your previous report, is not the same as you mentioned above. (You additionally need to file Form 8822 to make certain that your address has been changed with the IRS formally.)

Step 5: Over here you need to mention the unique customer file number that appears the same on the transcript requested. Although, this is not a compulsory step.

Step 6: This is the step where you mention the kind of transcript that you are looking for. In case you want a return transcript, account transcript, etc. Please note that with every form 4506-T that you file, you can only request for one transcript.

Step 7: Here you can choose and request any of the forms given and stated by the IRS.

Step 8: This is the most integral step, as it is here that you request for the period for which you need access to the transcript. The format for the same is (mm/dd/yyyy).

You have now duly filled the form. But before you sign on the last line as a representative, make sure that all the lines have been filled. You need to check thoroughly. And if you are wondering where to mail form 4506-T; you just need to mail it to the IRS.

Recent Developments in Form 4506-T:

Since 2019, the IRS tax 4506-T 2020 has abided with a new transcript format. Wherein, your SSN is masked completely with only the last 4 digits visible. This has been done to make sure that the transcripts can be easily sent to mortgage lender demands. You need to deliver the original copy to the IRS.

Wrapping Up:

You need to furnish old tax transcripts of your tax returns. Form 4506-T can help you attain these so that you can get access to the records of your tax cycles. There are various ways to be able to get those, form 4506-T assists you in the same. If you are looking to get copies of these transcripts in a streamlined manner, you can contact our team of expert tax specialists at Accounts Confidant. Call us today on our number +1-877-519-7362 today!