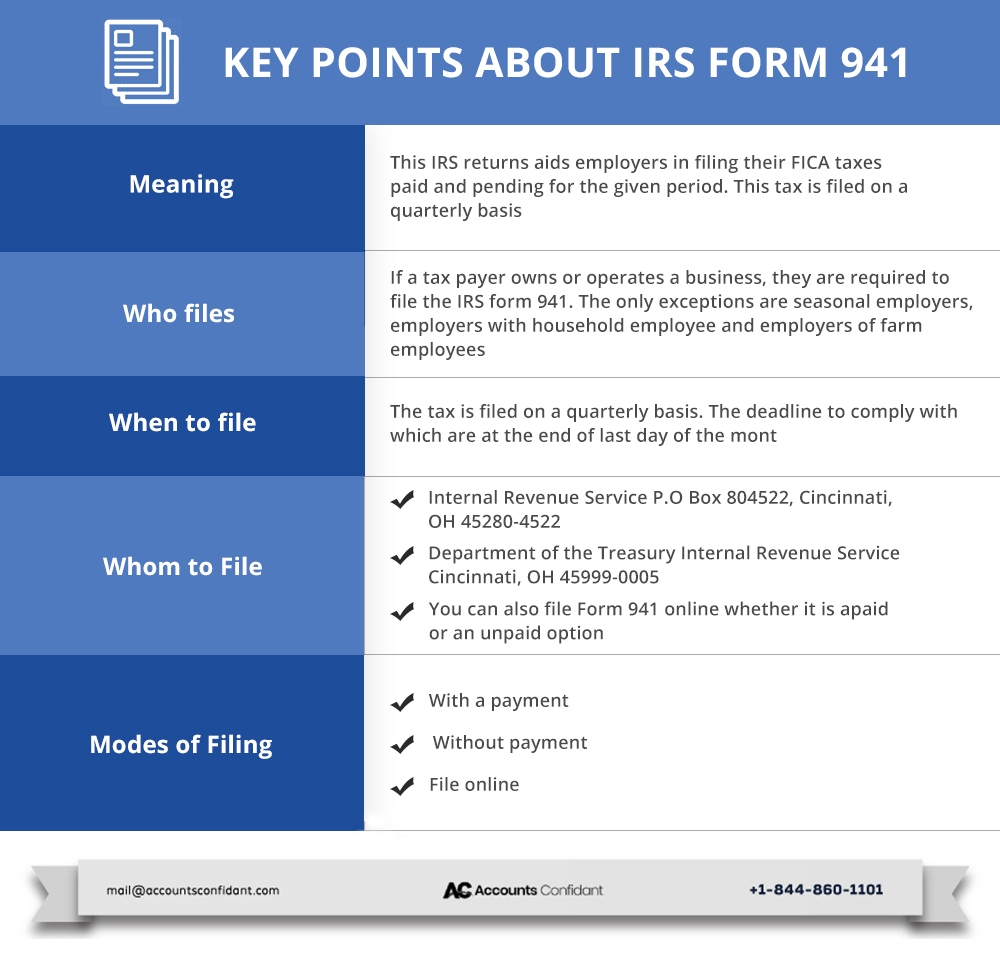

What do we Understand by Form 941?

IRS Form 941 is utilized by employers to report their federal withholdings. This form is also known as the Employer’s Quarterly Tax form. Additionally, you need to file the IRS form 941 four times (Quarterly) in a year. This Form informs the IRS of various vital figures like:

- Income Expenses or Taxes

- Social Welfare or Security Taxes

- Health Insurance Taxes

This employment tax is deducted from the employee’s pay as an amount payable to the IRS.

How To File IRS Form 941?

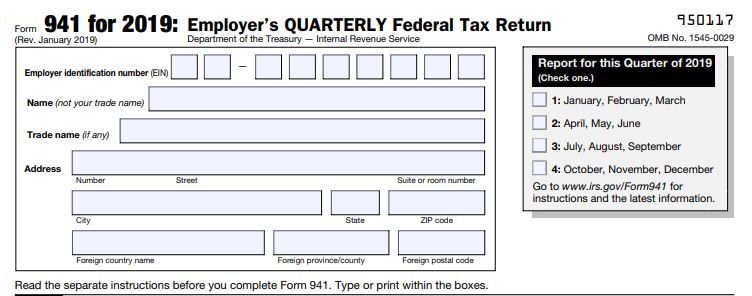

IRS Form consists of two pages which include six stages. In the first stage, you need to fill in the employees/general information. So, you need to complete the structure in the same way. Follow the given stages in an order to fill the form:

1. Give General Information and the Form 941 IRS Reporting Period

In this area, you will give general data about your business, for example, business name, charge ID, and postage information. You will likewise show the quarter that you are recording the arrival for.

2. Complete Form 941 Part 1 Lines 1 Through 15

The subsequent stage is to get done with the 15 lines of Form 941 Part 1:

Line 1 – Firstly, enter the all-out number of workers who got wages, tips, or other pay (like rewards or commission) in the quarterly payroll interval

Line 2 – Secondly, enter complete wages, tips, and other pay (like rewards or commission) paid to representatives

Line 3 – Thirdly, include government personal expense retained from representative wages, tips, and other remuneration (like rewards or commission) for the quarter

Line 4 – Select this checkbox if there are no wages, tips, or another pay subject to Social Security and Medicare charge

Lines 5 an and b – Meanwhile, enter the assessable Social Security compensation on line 5a and assessable Social Security tips on line 5b, and increase by the Social Security duty pace of 0.124

Lines 5 c and d – Also, enter the assessable Medicare compensation on line 5c and assessable Medicare tips on line 5d, and duplicate by the Medicare duty pace of 0.029

Line 5e – Add up lines 5a through 5d, Column 2, and enter the aggregate on this line

Line 5f – After that, enter charge due on unreported tips (see IRS Publication 15 for more data)

Lines 6-9 – Enter changes that apply (see IRS Publication 15 for more data)

Line 10 – Also, add up lines 6 through 9 and enter the aggregate on this line

Line 11 – Additionally, enter Small Business Payroll Tax Credit (see IRS Publication 15 for more data)

Line 12 – Subtract line 11 from line 10

Line 13 – Enter the all-out installments you made for the quarter, including retained personal assessment and worker and manager portion of Social Security and Medicare charges

Line 14 – After that, calculate funds to be paid, assuming any

Line 15 – Lastly, calculate the excessive charge.

3. Complete Form 941 Part 2 Line 16

In this area, you should choose the sort of contributor you were for the quarter (month to month or semiweekly). Meanwhile, you can refer to our table underneath for more data. Additionally, if you were a month to month contributor, you will enter the FUTA charge obligation for every month. Consequently, on the off chance that you were a semiweekly contributor, you should finish Schedule B.

4. Fill Form 941 Part 3 Lines 17 and 18

On the off chance that your business shut during the year or you let the majority of your workers go, you have to show the date you shut your business or potentially quit paying wages to representatives. What’s more, on the off chance that you are a regular business who does not need to record a quarterly 941 structure, you have to demonstrate that data in this segment also.

5. File Form 941 Part 4

As per the Form 941 directions, you can give your authorization for the IRS to address somebody about this structure for your benefit. For instance, you could put your CPA as an outsider designee. Meanwhile, make sure to incorporate their total name and phone number. In the event that you would prefer not to assign anybody, you can choose no.

6. Complete Form 941 Part 5

In this area, you will sign and date Form 941 demonstrating that you concur with the data that has been incorporated in this structure. Also, that as far as anyone is concerned, it is exact.

At last, you need to check whether the total amount reported on Form 941 must be equal to the amount you have reported on the W2 form that is distributed between employees and the amount you have reported on W-3 send to the government.

Where do we Mail IRS Form 941?

There are two mailing addresses in order to mail this Form 941 either with payment or without a payment: –

Case 1: With a payment

- Internal Revenue Service P.O Box 804522, Cincinnati, OH 45280-4522

Case 2: Without a payment

- Department of the Treasury Internal Revenue Service Cincinnati, OH 45999-0005

Case 3: File Online

- You can also file Form 941 online whether it is paid or unpaid option.

What are the Deadlines to file IRS Form 941?

If you too are planning to file this form 941 then you should know that the filing deadlines are always meant to be the last day of the decided months. It is filed generally on a quarterly basis and you have a complete month to prepare the form. Following are the deadlines of this form:

Quarter number | Deadline |

First Quarter ending on 31 march | 30 April |

Second Quarter ending on 30 June | 31 July |

Third Quarter ending on 30 September | 31 October |

Fourth Quarter ending on 31 December | 31 January |

Note: if the due date falls on a holiday then the next due date will be the next business day. For example, if the due date falls on Saturday (holiday) then, the next due date will be on Monday.

What are the Penalties for failing to file IRS form 941?

If you did not file the form 941 on time, then you have to bear the following penalties:

- Firstly, 5% of unpaid tax with that return for each month.

- Additionally, the maximum limit of the penalty is 25%.

- Additional penalty for paying less than you be in debt.

- Also, the IRS will charge between 2% to 15% that depends on how many days is your payment delayed.

Common mistakes that can happen while Filing IRS Form 941

Given below are the mistakes that can happen at the time of filing IRS Form 941:

- Firstly, you have entered the wrong amount in one of the boxes.

- Secondly, these errors can be related to tips, wages or other pay (rewards or compensation).

- Thirdly, if you have entered the incorrect amount of social security wages and tips or the Medicare wages and tips.

However, this error may result in over-reporting and you have to pay too much or vice-versa. You need to make an adjustment. But, you will be unable to make an adjustment in the same form. Meanwhile, the filer needs to use a separate 941X form to correct the mistakes.

How to correct mistakes on form 941?

You can again fill in the required information by using the above steps in a separate 941X form that is directly related line-to-line to form 941.

Conclusion:

In this article till now as readers, you must have understood what is IRS Form 941 and how crucial is to file this form for every entrepreneur. Whereas, this form serves as an important aspect for every business house. In case, you have any issues in filing Form 941 then, do not hesitate and call us at Account Confidant on our Toll-Free +1-877-519-7362 in order to get a better purview with regards to IRS Form 941.