Taxes are unavoidable! Whether you are earning as a business owner or a salaried person. But everything will remain streamlined if you pay your taxes on time. You can only…

Learn More

Taxes are unavoidable! Whether you are earning as a business owner or a salaried person. But everything will remain streamlined if you pay your taxes on time. You can only…

Learn More

Every employee serves as a pillar for your business; those pillars take it to a high pedestal and mark its presence in the market. Those pillars include the sales team,…

Learn More

A report from the United States Small Business Administration states that- 50% of the small businesses fail in their first 5 years because of their financial mismanagement. Yes, the report…

Learn More

According to the reports, a small Business should opt for virtual accounting services as soon as their profit margins start accelerating. Taking the report forward, it will be appropriate to…

Learn More

Every business account must show the true digits; this can be achieved when they are reconciled properly. The business owner should ask the bookkeeper to undertake the account reconciliation process…

Learn More

Reconciliation is a fundamental accounting process of matching and balancing two sets of records. This would mean that the money leaving the account is matching the money spent. This is…

Learn More

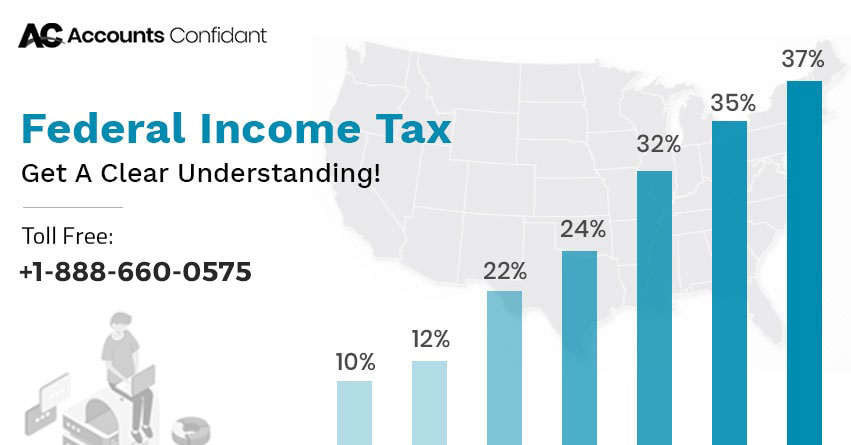

What Is Federal Income Tax? To understand the meaning of the term Federal Income Tax, it is important to bifurcate it into the two important terms that make it. Doing…

Learn MoreEveryone wants to make sure that they have a comfortable retirement. And for this every individual needs to make some nondeductible contributions. These contributions should be made to an Individual…

Learn More

Looking for help? Talk To Our Bookkeeping And Taxation Experts and Get Your Issue Solved!

Toll-Free: 1-844-860-1101